Question: Net Present Value-Unequal Lives Bunker Hill Mining Compary has two competing proposals: a processing mill and an electric shovel. Both pleces of equipment have an

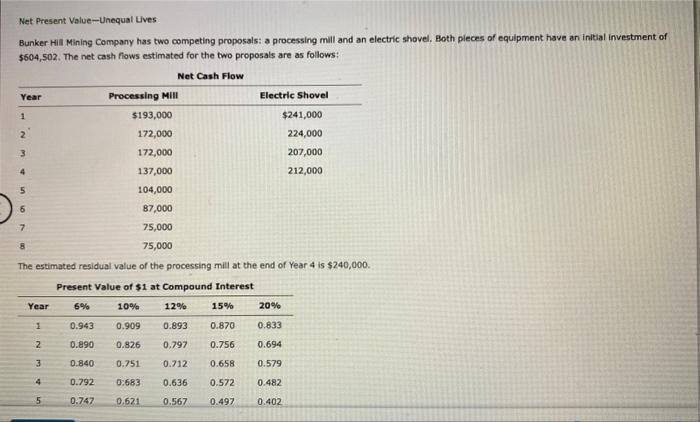

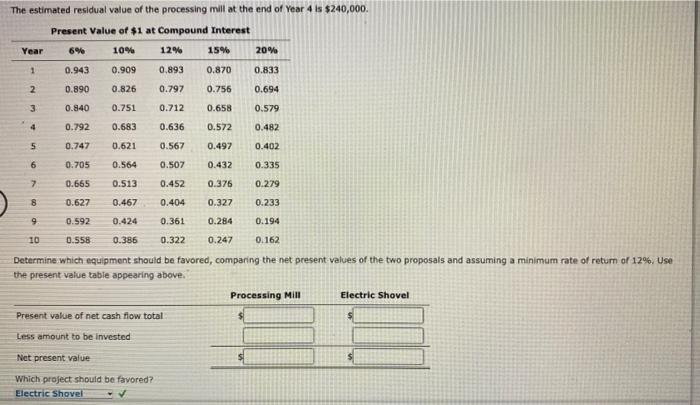

Net Present Value-Unequal Lives Bunker Hill Mining Compary has two competing proposals: a processing mill and an electric shovel. Both pleces of equipment have an initial investment of 5604,502 . The net cash flows estimated for the two proposals are as follows: The estimated residual value of the processing mill at the end of Year 4 is $240,000. The estimated residual value of the processing mill at the end of Year 4 is $240,000. Present Value of $1 at Compound Interest Determine which equipment should be favored, comparing the net present-values of the two proposals and assuming a minimum rate of retum of 12%. Use the present value table appearing above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts