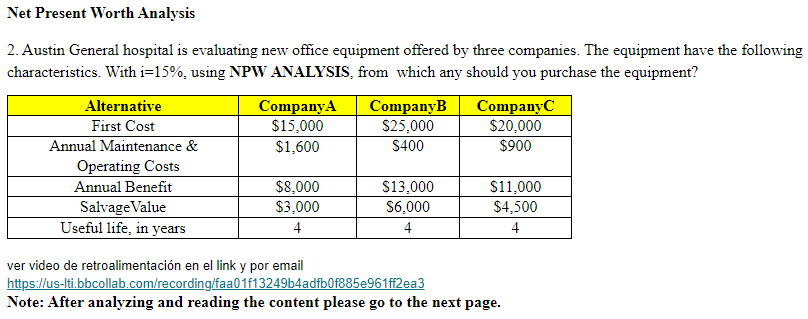

Question: Net Present worth analysis problem #2 Net Present Worth Analysis 2. Austin General hospital is evaluating new office equipment offered by three companies. The equipment

Net Present worth analysis

problem #2

Net Present Worth Analysis 2. Austin General hospital is evaluating new office equipment offered by three companies. The equipment have the following characteristics. With 1=15%, using NPW ANALYSIS, from which any should you purchase the equipment? Alternative CompanyA CompanyB CompanyC First Cost $15,000 $25,000 $20,000 Annual Maintenance & $1,600 $400 $900 Operating Costs Annual Benefit $8.000 $13.000 $11.000 Salvage Value $3,000 $6.000 $4,500 Useful life, in years 4 4 4 ver video de retroalimentacion en el link y por email https://us-Iti.bbcollab.com/recording/faa01f13249b4adfbOf885e961ff2ea3 Note: After analyzing and reading the content please go to the next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts