Question: Net profit under absorption costing may differ from net profit determined under variable costing. How is this difference calculated? a. number of units produced during

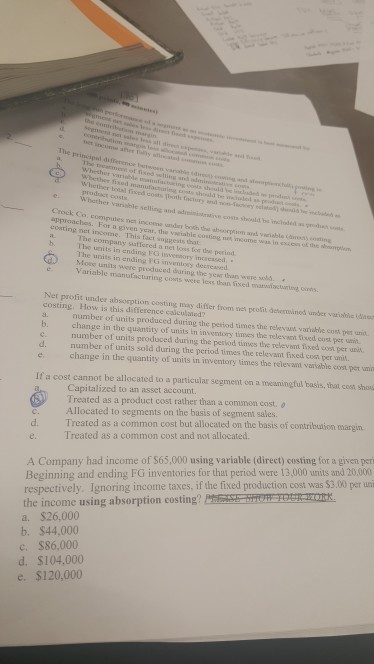

Net profit under absorption costing may differ from net profit determined under variable costing. How is this difference calculated? a. number of units produced during the period times the relevant variable cost per unit. b. change in the quantity of units in inventory times the relevant fixed cost per unit. c. number of units produced during the period times the relevant fixed cost per unit. d. number of units sold during the period times the relevant fixed cost per unit. e. change in the quantity of units in inventory times the relevant variable cost per If a cost cannot be allocated to a particular segment on a meaningful basis, that cost should a. Capitalized to an asset account. b. Treated as a product cost rather than a common cost. c. Allocated to segments on the basis of segment sales. d. Treated as a common cost but allocated on the basis of contribution margin. e. Treated as a common cost and not allocated. A Company had income of $65,000 using variable (direct) costing for a given Beginning and ending FG inventories for that period were 13,000 units and 20,000 respectively. Ignoring income taxes, if the fixed production cost was $3.00 per the income using absorption costing? a. $26,000 b. $44,000 c. $86,000 d. $104,000 e. $120,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts