Question: Net Realizable Value Method, Decision to Sell at Split - off or Process Further beyond the split - off point were as follows: ins, $

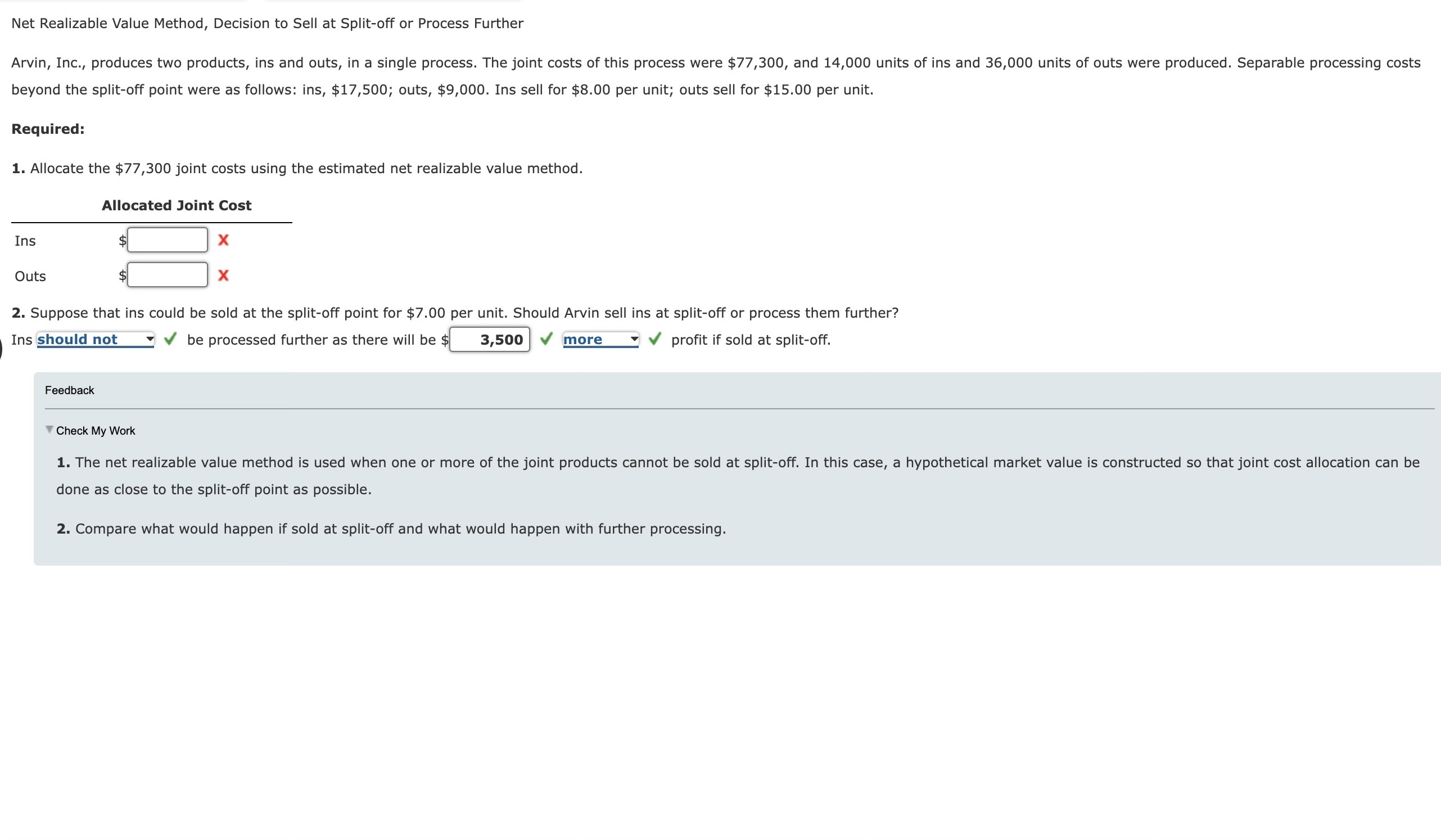

Net Realizable Value Method, Decision to Sell at Splitoff or Process Further

beyond the splitoff point were as follows: ins, $; outs, $ Ins sell for $ per unit; outs sell for $ per unit.

Required:

Allocate the $ joint costs using the estimated net realizable value method.

Suppose that ins could be sold at the splitoff point for $ per unit. Should Arvin sell ins at splitoff or process them further?

Ins

be processed further as there will be :

profit if sold at splitoff.

Feedback

Check My Work

done as close to the splitoff point as possible.

Compare what would happen if sold at splitoff and what would happen with further processing.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock