Question: Net return question. Please show work. Reference: 14. Suppose the prices of Stock A and B change over time as follows. t+1 t+2 Pt $100

Net return question. Please show work.

Reference:

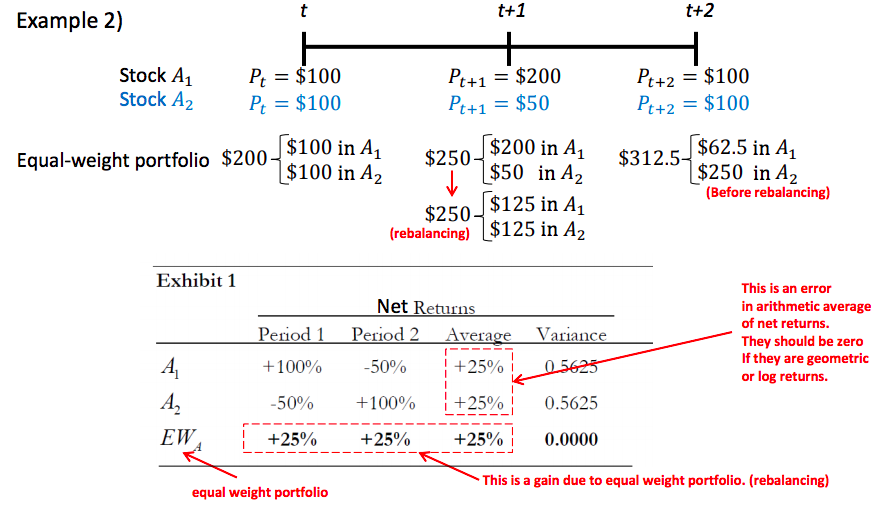

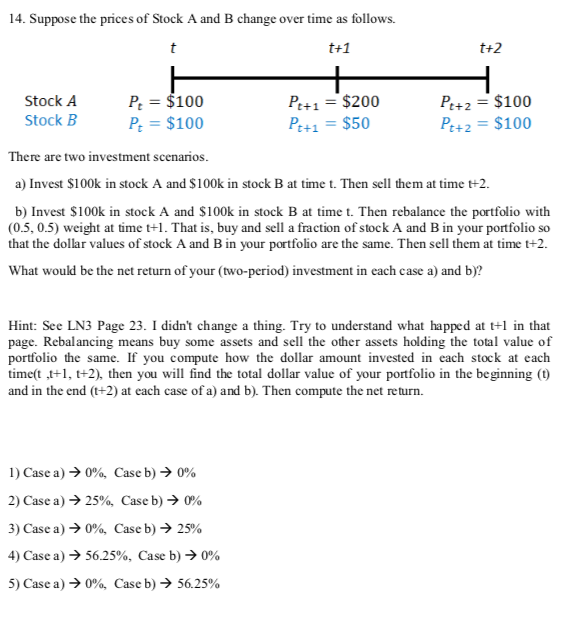

14. Suppose the prices of Stock A and B change over time as follows. t+1 t+2 Pt $100 Pt $100 There are two investment scenarios Stock A Stock B +1$200 Pt+1$50 Pt+2- $100 Pt+2 -$100 a) Invest S100k in stock A and $100k in stock B at time t. Then sell them at time t+2 b) Invest $100k in stock A and $100k in stock B at time t. Then rebalance the portfolio with (0.5, 0.5) weight at time t+1. That is, buy and sell a fraction of stock A and B in your portfolio so that the dollar values of stock A and B in your portfolio are the same. Then sell them at time t+2. What would be the net return of your (two-period) investment in each case a) and b)? Hint: See LN3 Page 23. I didn't change a thing. Try to understand what happed at t+ in that page. Rebalancing means buy some assets and sell the other assets holding the total value of portfolio the same. If you compute how the dollar amount invested in each stock at each time(t 1, t+2), then you will find the total dollar value of your portfolio in the beginning (t) and in the end (t+2) at each case of a) and b). Then compute the net return. 1) Case a) 0%, Case b) 0% 2) Case a)-) 25%, Case b) 090 3) Case a)-) 0%, Case b)-) 25% 4) Case a)-) 56.25%, Case b)-) 0% 5) Case a)-) 0%, Case b)-) 56.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts