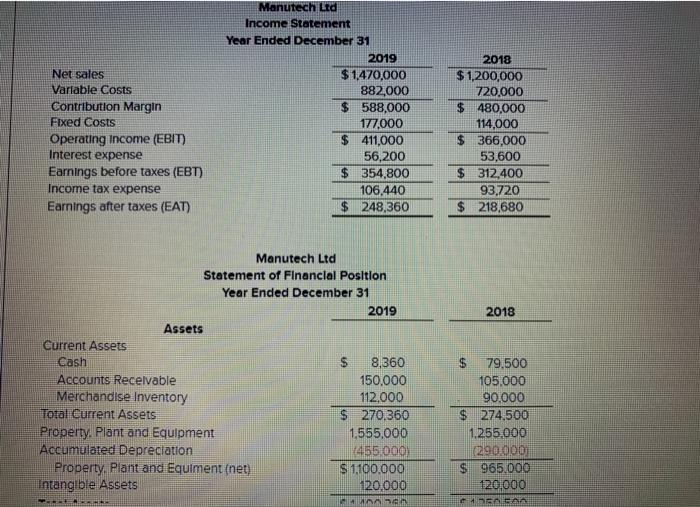

Question: Net sales Variable Costs Contribution Margin Fixed Costs Operating Income (EBIT) Interest expense Earnings before taxes (EBT) Income tax expense Earnings after taxes (EAT) Manutech

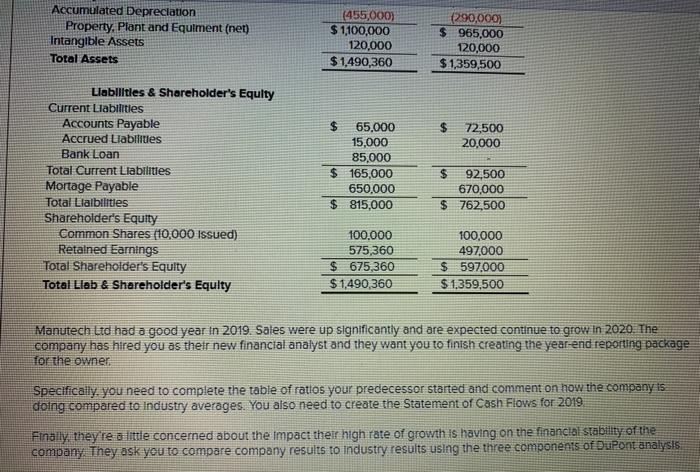

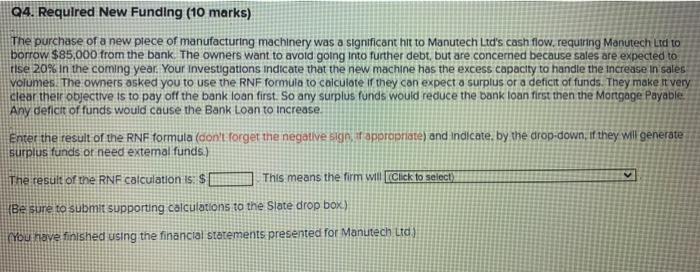

Net sales Variable Costs Contribution Margin Fixed Costs Operating Income (EBIT) Interest expense Earnings before taxes (EBT) Income tax expense Earnings after taxes (EAT) Manutech Ltd Income Statement Year Ended December 31 2019 $1,470,000 882,000 $ 588,000 177.000 $ 411,000 56,200 $ 354,800 106.440 $ 248,360 2018 $ 1,200,000 720,000 $ 480,000 114.000 $ 366,000 53,600 $ 312,400 93,720 $ 218,680 2018 Manutech Ltd Statement of Financial Position Year Ended December 31 2019 Assets Current Assets Cash $ 8,360 Accounts Receivable 150,000 Merchandise Inventory 112.000 Total Current Assets $ 270.360 Property. Plant and Equipment 1,555.000 Accumulated Depreciation 4455.000) Property. Plant and Equiment (net) S 1.100.000 Intangible Assets 120.000 79.500 105.000 90.000 $ 274.500 1.255.000 (2900002 $ 965,000 120.000 BACAA Accumulated Depreciation Property. Plant and Equiment (net) Intangible Assets Total Assets (455,000) $1,100,000 120,000 $ 1,490,360 (290,000) $ 965,000 120,000 $1,359,500 $ 72,500 20,000 Llabilities & Shareholder's Equity Current Liabilities Accounts Payable Accrued Liabilites Bank Loan Total Current Liabilities Mortage Payable Total Llalbilities Shareholder's Equity Common Shares (10,000 Issued) Retained Earnings Total Shareholder's Equity Total Llab & Shareholder's Equity $ 65,000 15,000 85,000 $ 165,000 650,000 $ 815,000 $ 92,500 670,000 $ 762,500 100.000 575,360 $ 675,360 $ 1,490,360 100,000 497.000 $ 597.000 $ 1.359,500 Manutech Ltd had a good year in 2019. Sales were up significantly and are expected continue to grow in 2020. The company has hired you as their new financial analyst and they want you to finish creating the year-end reporting package for the owner Specifically, you need to complete the table of ratlos your predecessor started and comment on how the company is doing compared to Industry averages. You also need to create the Statement of Cash Flows for 2019 Finally, they're a little concerned about the impact their high rate of growth is having on the financial stability of the company. They ask you to compare company results to Industry results using the three components of DuPont analysis Q4. Required New Funding (10 marks) The purchase of a new plece of manufacturing machinery was a significant hit to Manutech Ltd's cash flow requiring Manutech urd to borrow $85,000 from the bank. The owners want to avoid going into further debt, but are concerned because sales are expected to tise 20% in the coming year. Your investigations indicate that the new machine has the excess capacity to handle the increase in sales volumes. The owners asked you to use the RNF formula to calculate if they can expect a surplus or a deficit of funds. They make it very clear their objective is to pay off the bank loan first. So any surplus funds would reduce the bank loan first then the Mortgage Payable. Any deficit of funds would cause the Bank Loan to increase Enter the result of the RNF formula (con't forget the negative sigor appropriate) and indicate, by the drop-down, if they will generate surplus funds of need extemal funds.) The result of the RNF calculation is: $ This means the firm will Click to select) Be sure to submit supporting calculations to the Slate drop box) myou nave finished using the financial statements presented for Manutech Ltd)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts