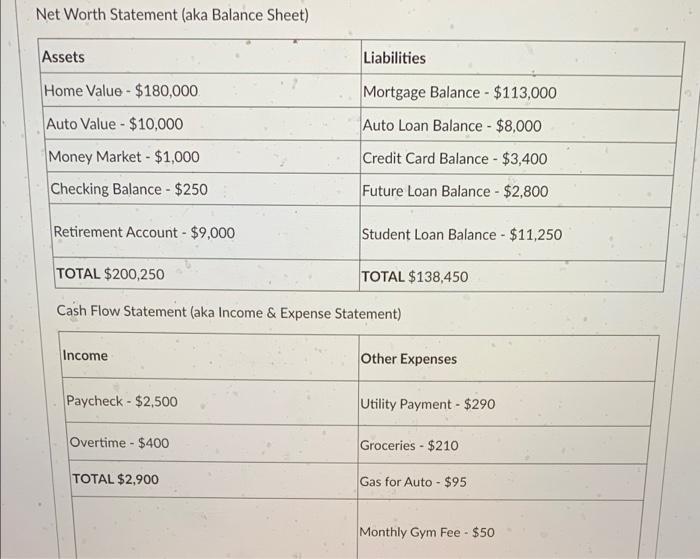

Question: Net Worth Statement (aka Balance Sheet) Assets Liabilities Home Value - $180,000 Mortgage Balance - $113,000 Auto Loan Balance - $8,000 Auto Value - $10,000

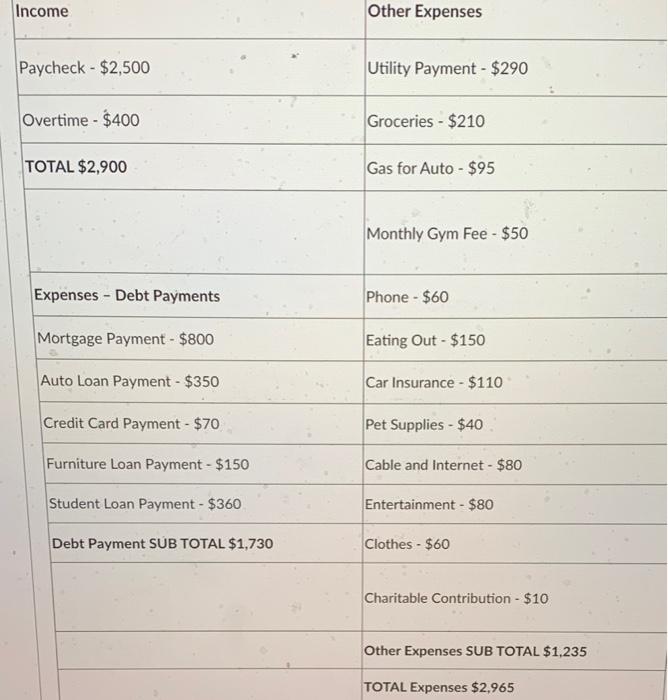

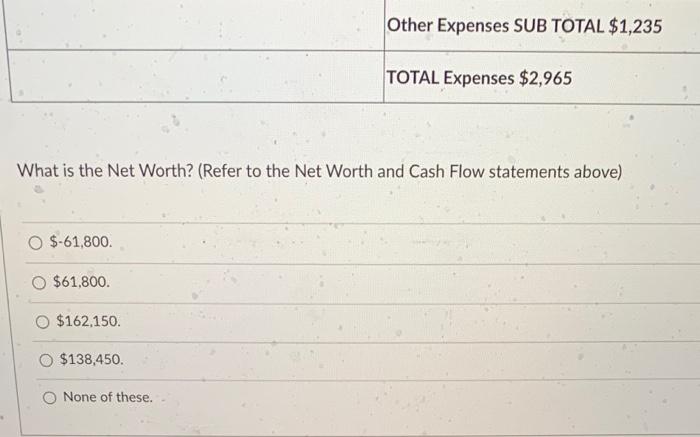

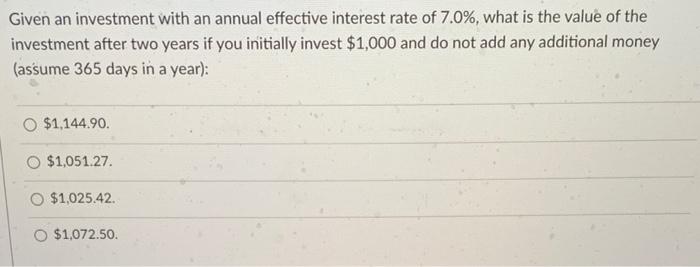

Net Worth Statement (aka Balance Sheet) Assets Liabilities Home Value - $180,000 Mortgage Balance - $113,000 Auto Loan Balance - $8,000 Auto Value - $10,000 Money Market - $1,000 Checking Balance - $250 Credit Card Balance - $3,400 Future Loan Balance - $2,800 Retirement Account - $9,000 Student Loan Balance - $11,250 TOTAL $200,250 TOTAL $138,450 Cash Flow Statement (aka Income & Expense Statement) Income Other Expenses Paycheck - $2,500 Utility Payment - $290 - Overtime - $400 Groceries - $210 TOTAL $2,900 Gas for Auto - $95 Monthly Gym Fee - $50 - Income Other Expenses Paycheck - $2,500 Utility Payment - $290 Overtime - $400 Groceries - $210 TOTAL $2,900 Gas for Auto - $95 Monthly Gym Fee - $50 Expenses - Debt Payments Phone - $60 Mortgage Payment - $800 Eating Out - $150 Auto Loan Payment - $350 Car Insurance - $110 Credit Card Payment - $70 Pet Supplies - $40 Furniture Loan Payment - $150 Cable and Internet - $80 Student Loan Payment - $360 Entertainment - $80 - Debt Payment SUB TOTAL $1,730 Clothes - $60 Charitable Contribution - $10 Other Expenses SUB TOTAL $1,235 TOTAL Expenses $2,965 Other Expenses SUB TOTAL $1,235 TOTAL Expenses $2,965 What is the Net Worth? (Refer to the Net Worth and Cash Flow statements above) O $-61,800 $61,800 $162.150. O $138,450. None of these. Given an investment with an annual effective interest rate of 7.0%, what is the value of the investment after two years if you initially invest $1,000 and do not add any additional money (assume 365 days in a year): $1,144.90 $1,051.27. $1,025.42 $1,072.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts