Question: Never round intermediary steps (or keep at least 4 decimal places), SHOW ALL WORK, and LABEL your answers. Problem #1: Calculating Present Value for Multiple

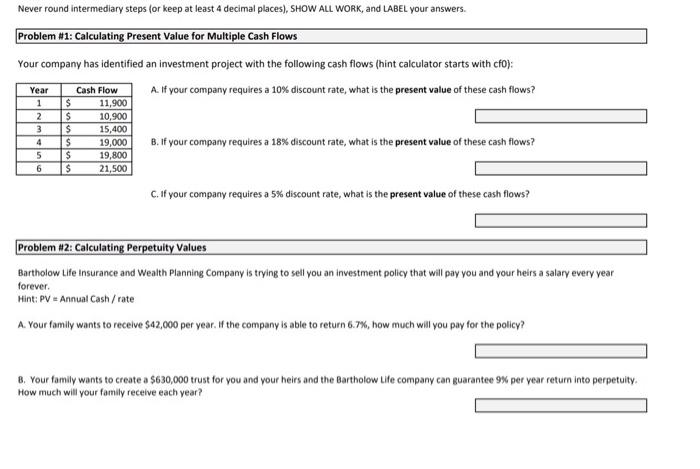

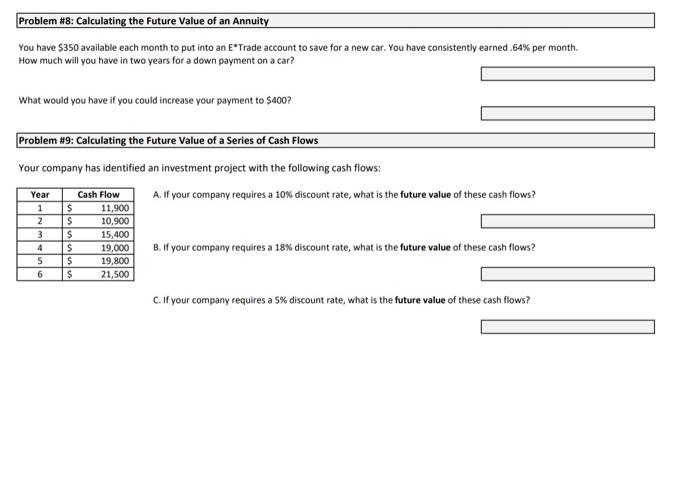

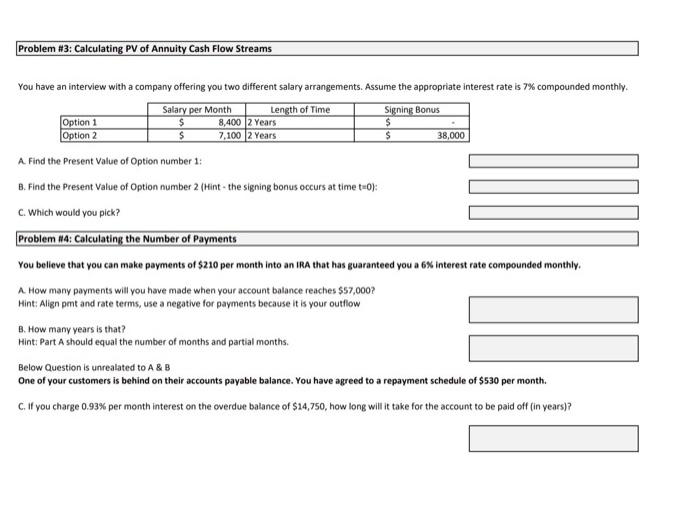

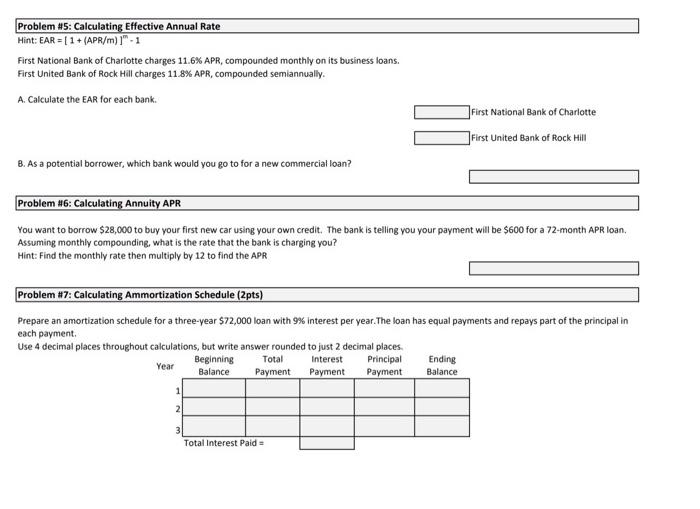

Never round intermediary steps (or keep at least 4 decimal places), SHOW ALL WORK, and LABEL your answers. Problem #1: Calculating Present Value for Multiple Cash Flows Your company has identified an investment project with the following cash flows (hint calculator starts with cro): Year A. If your company requires a 10% discount rate, what is the present value of these cash flows? $ 11,900 $ 10,900 3 $ 15,400 $ 19,000 B. If your company requires a 18% discount rate, what is the present value of these cash flows? $ 19,800 $ 21,500 Cash Flow 1 2 4 5 6 C. If your company requires a 5% discount rate, what is the present value of these cash flows? Problem #2: Calculating Perpetulty Values Bartholow Life Insurance and Wealth Planning Company is trying to sell you an investment policy that will pay you and your heirs a salary every year forever. Hint: PV - Annual Cash/rate A. Your family wants to receive $42,000 per year. If the company is able to return 6.7%, how much will you pay for the policy? 8. Your family wants to create a $630,000 trust for you and your heirs and the Bartholow Life company can guarantee 9% per year return into perpetuity. How much will your family receive each year? Problem #8: Calculating the Future Value of an Annuity You have $350 available each month to put into an E*Trade account to save for a new car. You have consistently earned .64% per month How much will you have in two years for a down payment on a car? What would you have if you could increase your payment to $400? Problem #9: Calculating the Future Value of a Series of Cash Flows Your company has identified an investment project with the following cash flows: A. If your company requires a 10% discount rate, what is the future value of these cash flows ? $ 11,900 $ $ 15,400 B. If your company requires a 18% discount rate, what is the future value of these cash flows? Cash Flow 10,900 Year 1 2 3 4 5 6 $ $ $ 19,000 19,800 21,500 C. If your company requires a 5% discount rate, what is the future value of these cash flows? Problem #3: Calculating PV of Annuity Cash Flow Streams You have an interview with a company offering you two different salary arrangements. Assume the appropriate interest rate is 7% compounded monthly Salary per Month Length of Time Signing Bonus Option 1 $ 8,400 2 Years $ Option 2 $ 7,100 2 Years $ 38,000 A Find the Present Value of Option number 1: B. Find the Present Value of Option number 2 (Hint- the signing bonus occurs at time t=0); C. Which would you pick? Problem #4: Calculating the Number of Payments You believe that you can make payments of $210 per month into an IRA that has guaranteed you a 6% interest rate compounded monthly A How many payments will you have made when your account balance reaches $57,000? Hint: Align pit and rate terms, use a negative for payments because it is your outflow B. How many years is that? Hint: Part A should equal the number of months and partial months Below Question is unrealated to A & B One of your customers is behind on their accounts payable balance. You have agreed to a repayment schedule of $530 per month. C. If you charge 0.93% per month interest on the overdue balance of $14,750, how long will it take for the account to be paid off (in years)? a Problem #5: Calculating Effective Annual Rate Hint: EAR = [ 1 + (APR/m))" - 1 First National Bank of Charlotte charges 11.6% APR, compounded monthly on its business loans. First United Bank of Rock Hill charges 11.8% APR, compounded semiannually. A. Calculate the EAR for each bank. First National Bank of Charlotte First United Bank of Rock Hill 8. As a potential borrower, which bank would you go to for a new commercial loan? Problem #6: Calculating Annuity APR You want to borrow $28,000 to buy your first new car using your own credit. The bank is telling you your payment will be $600 for a 72-month APR loan, Assuming monthly compounding, what is the rate that the bank is charging you? Hint: Find the monthly rate then multiply by 12 to find the APR Problem #7: Calculating Ammortization Schedule (2pts) Prepare an amortization schedule for a three-year $72,000 loan with 9% interest per year. The loan has equal payments and repays part of the principal in each payment Use 4 decimal places throughout calculations, but write answer rounded to just 2 decimal places. Beginning Total Interest Principal Year Ending Balance Payment Payment Payment Balance 1 2 3 Total Interest Paid =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts