Question: Neveranerror Inc. was organized on June 2 by a group of accountants to provide accounting and tax services to small businesses. The following transactions occurred

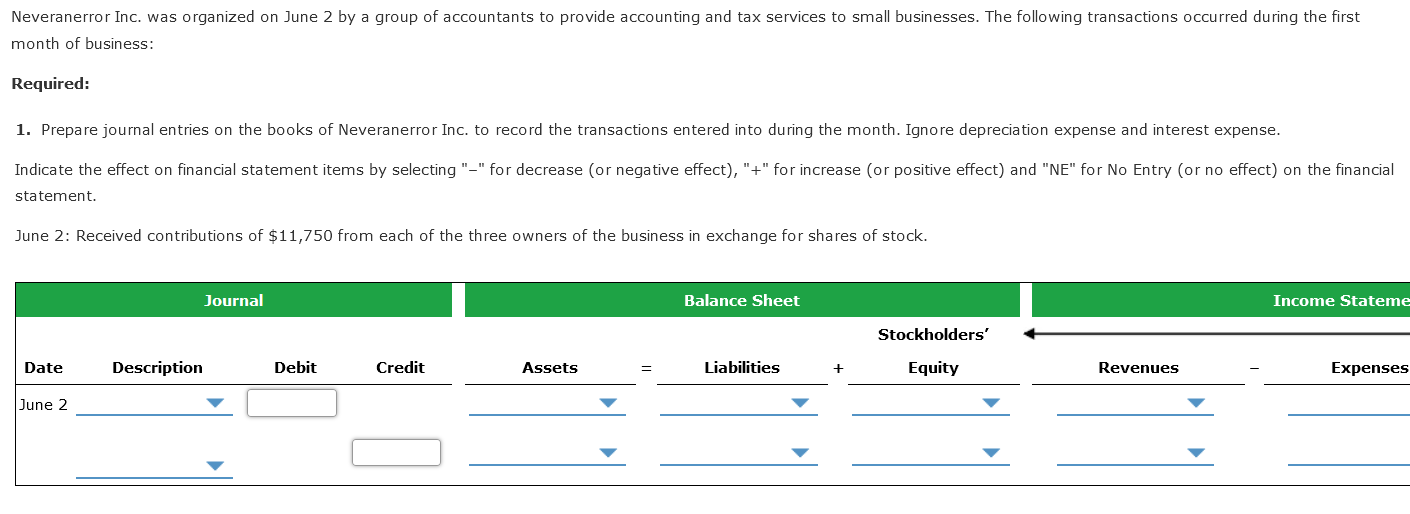

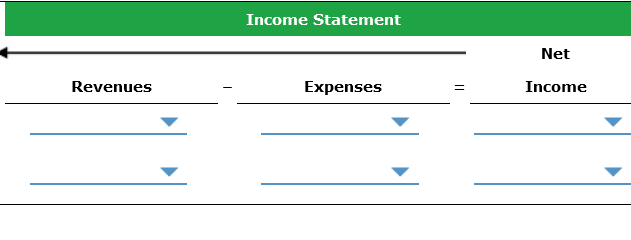

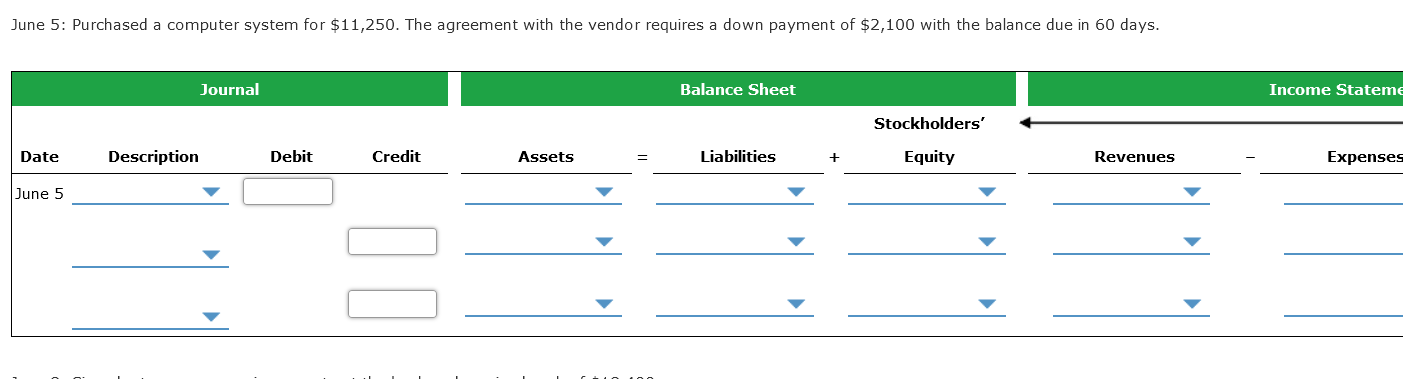

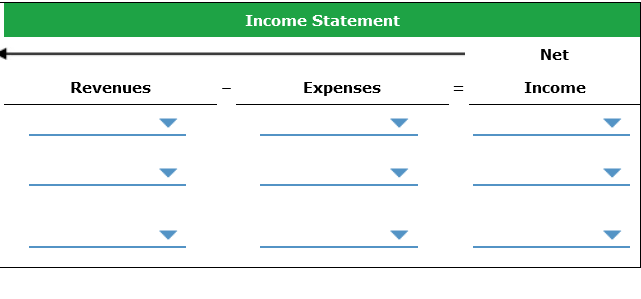

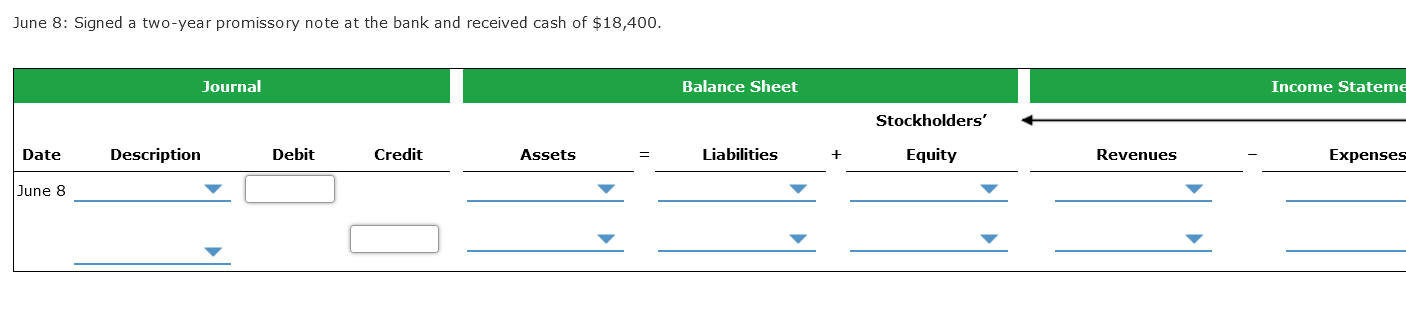

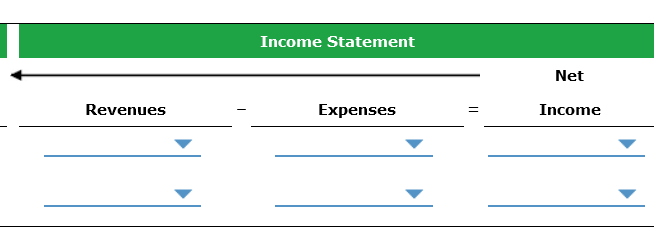

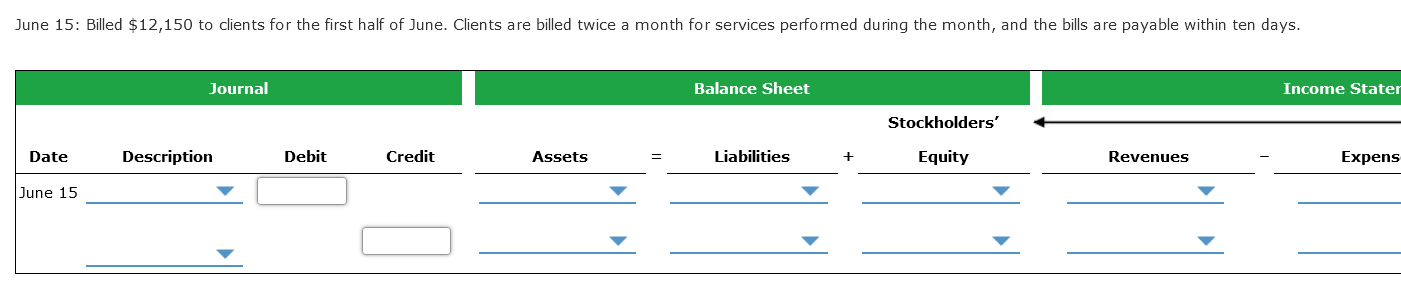

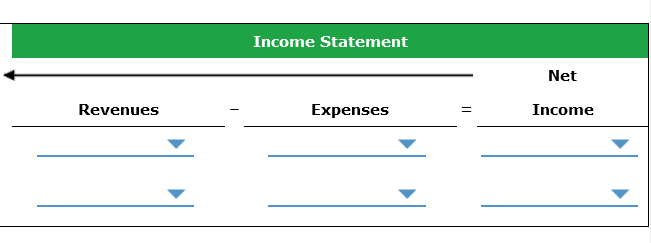

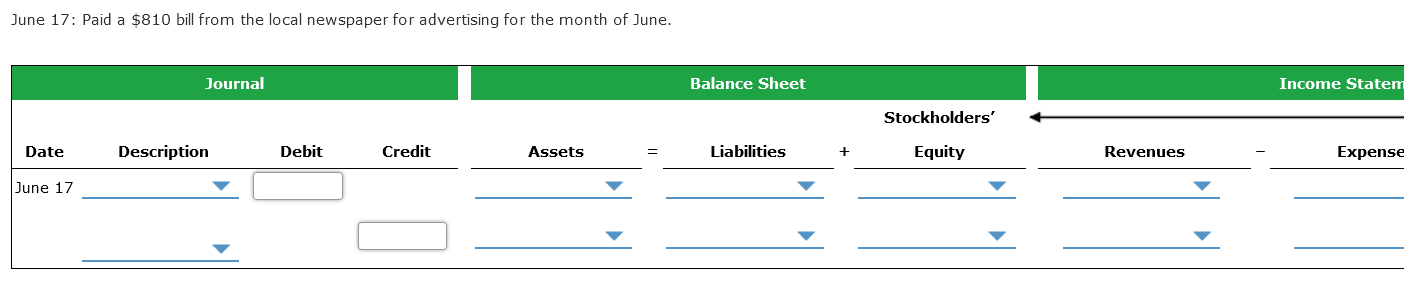

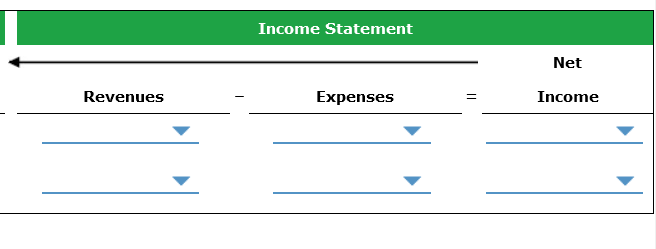

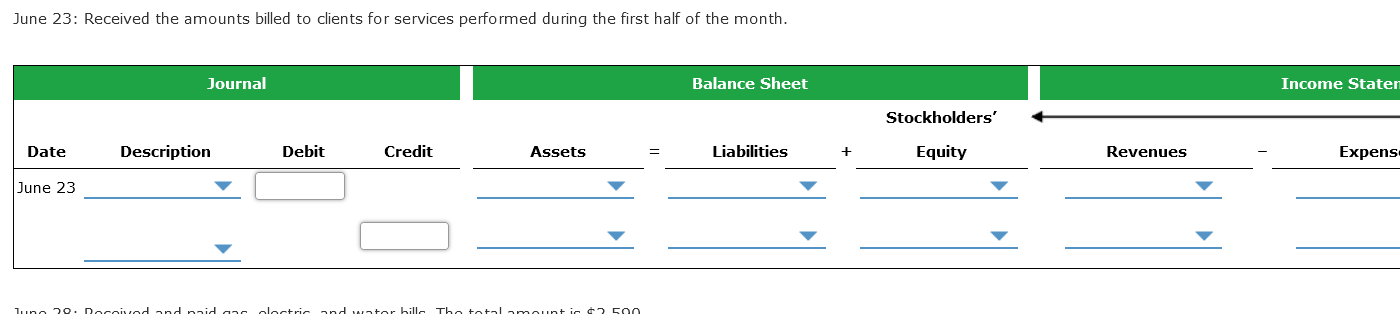

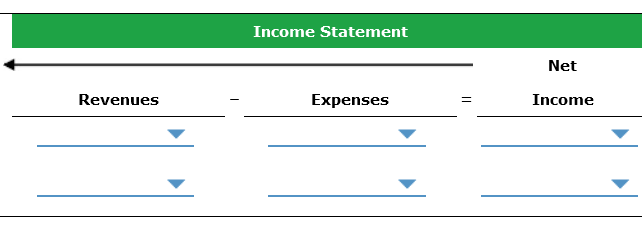

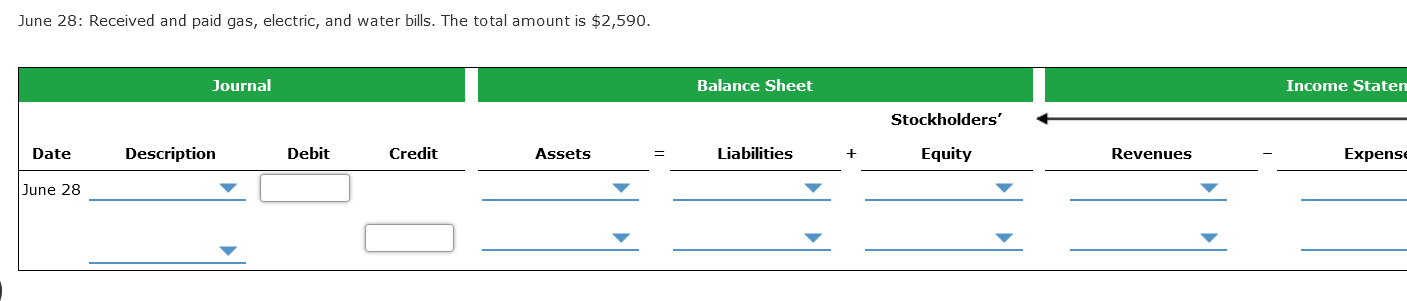

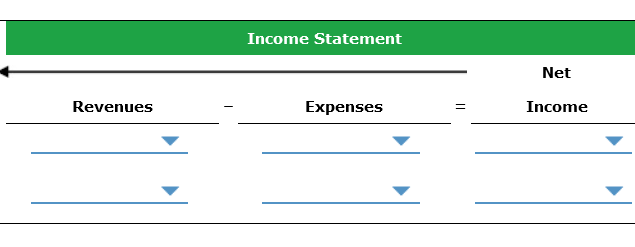

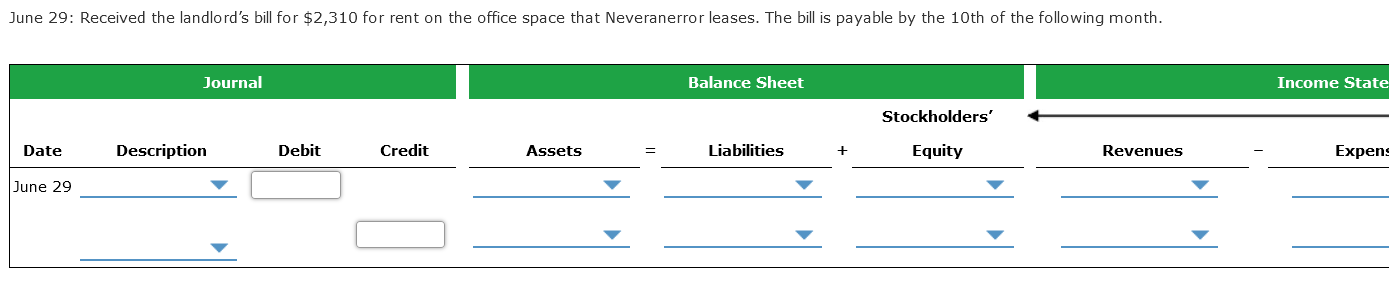

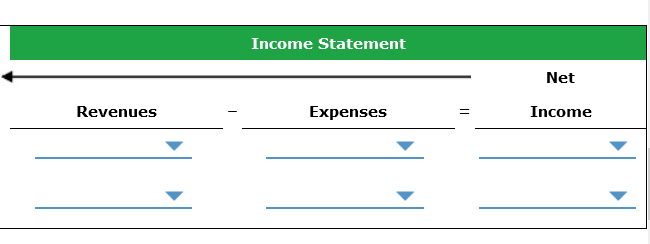

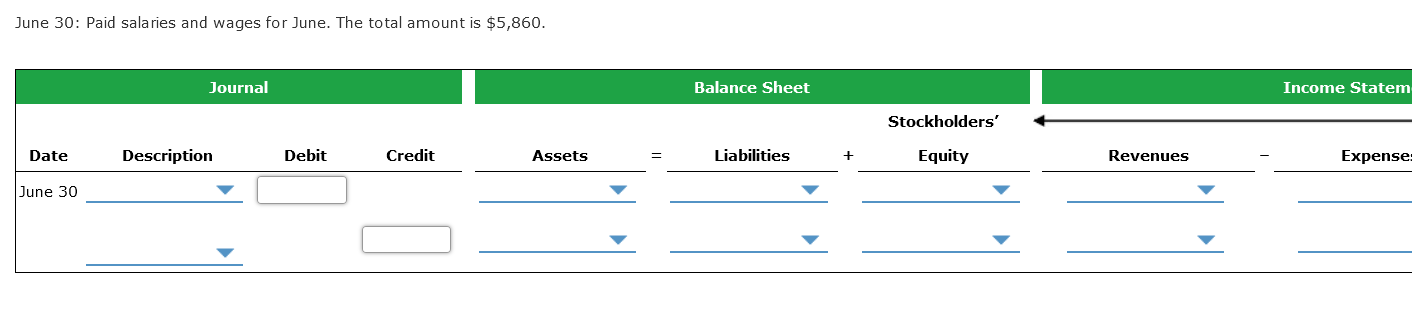

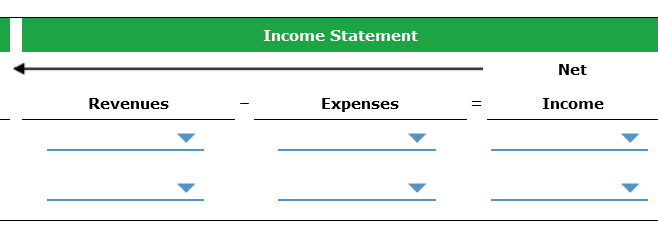

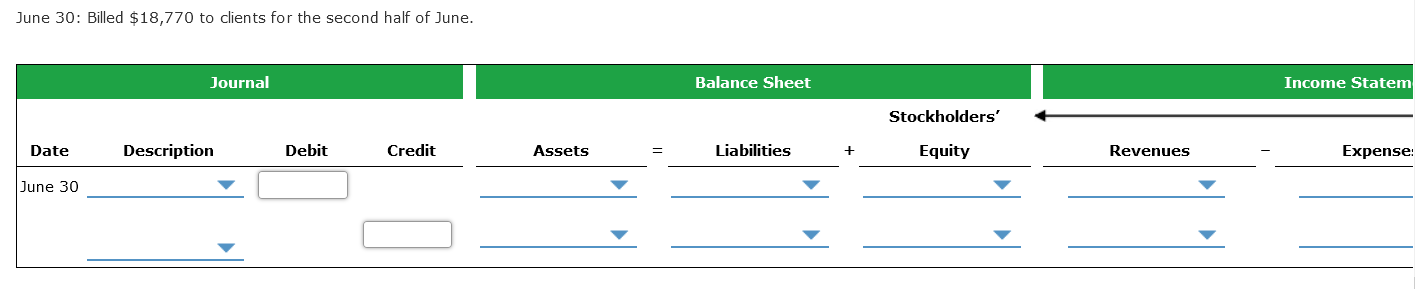

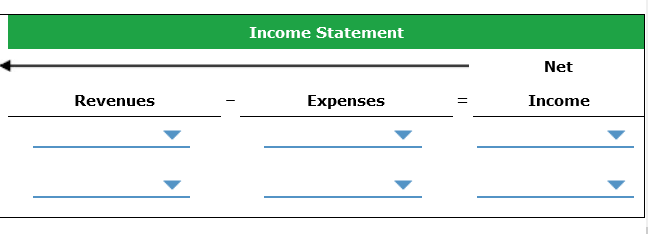

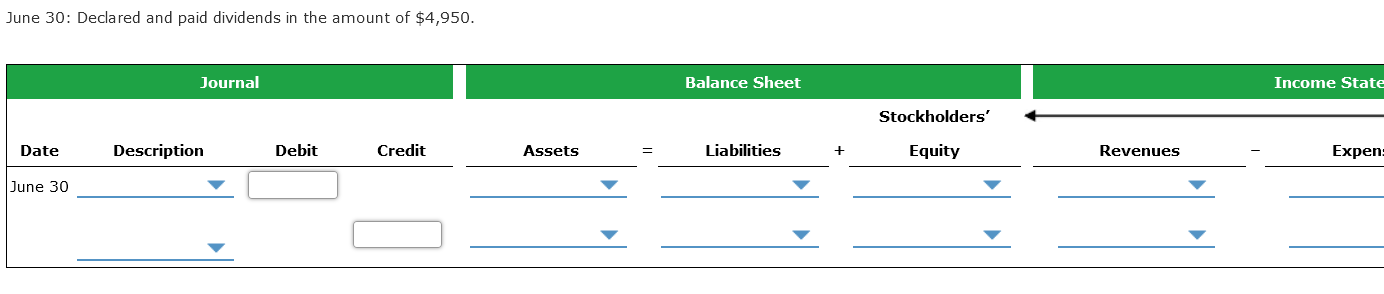

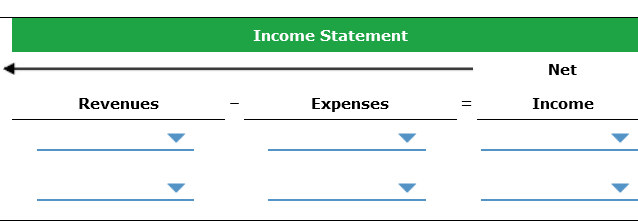

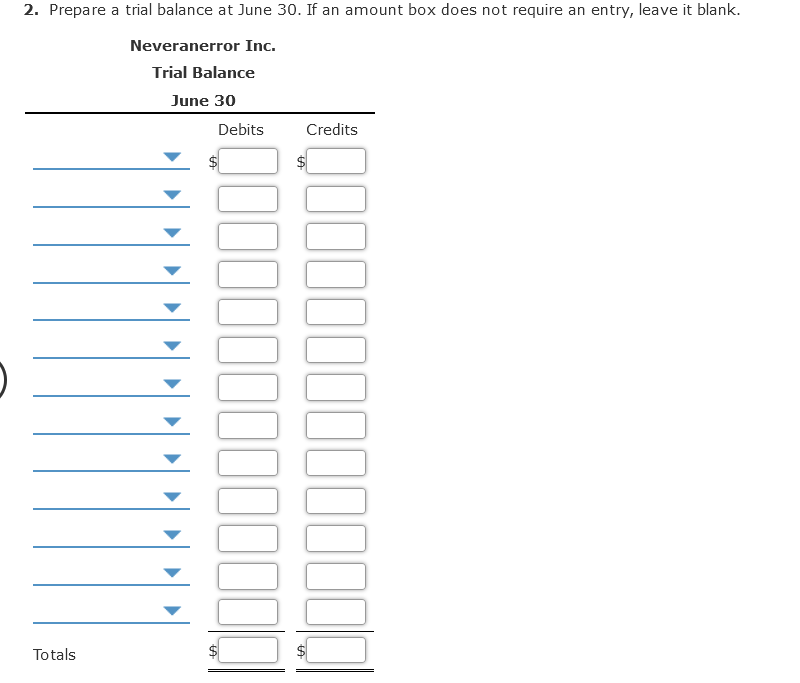

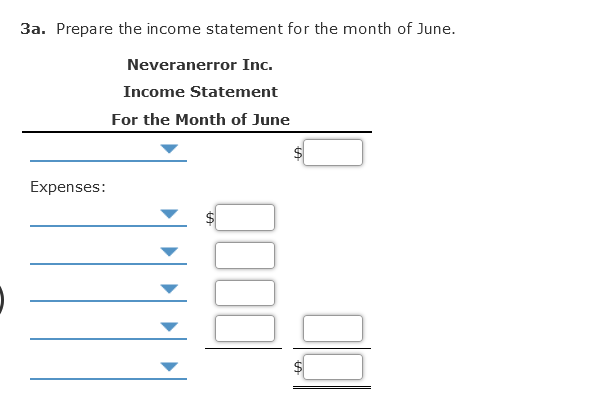

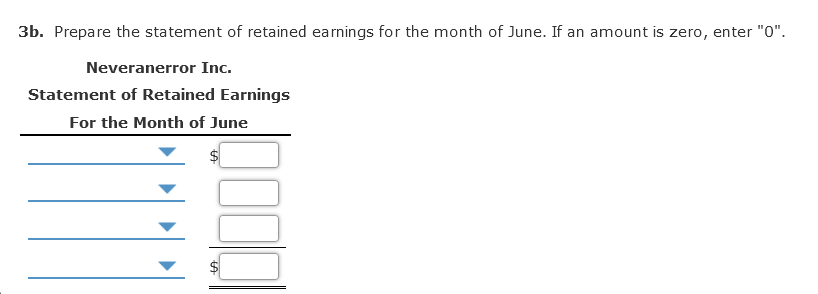

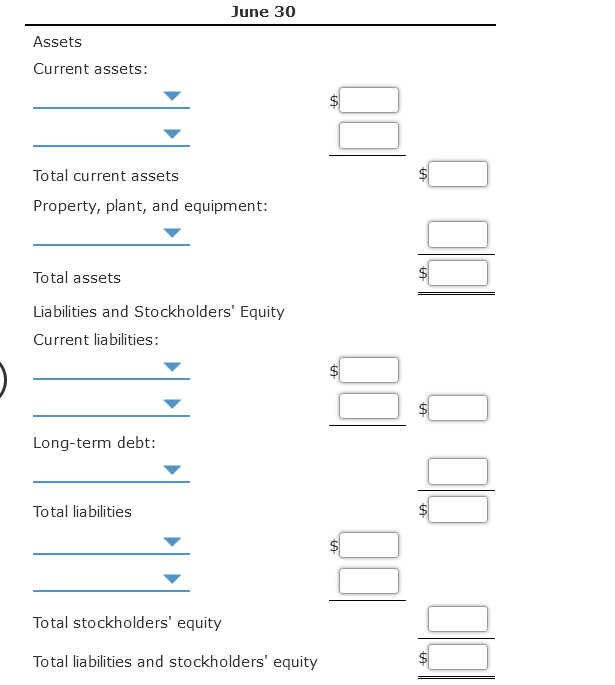

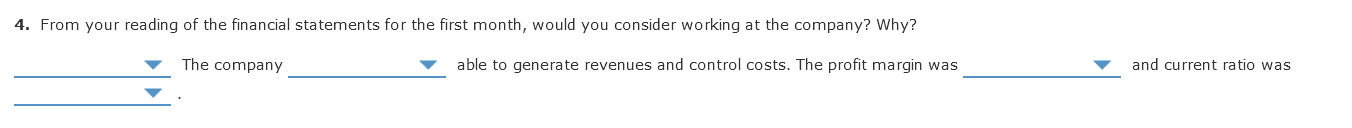

Neveranerror Inc. was organized on June 2 by a group of accountants to provide accounting and tax services to small businesses. The following transactions occurred during the first month of business: Required: 1. Prepare journal entries on the books of Neveranerror Inc. to record the transactions entered into during the month. Ignore depreciation expense and interest expense. Indicate the effect on financial statement items by selecting "-" for decrease (or negative effect),"+" for increase (or positive effect) and "NE" for No Entry (or no effect) on the financial statement. June 2: Received contributions of $11,750 from each of the three owners of the business in exchange for shares of stock. Journal Balance Sheet Income Stateme Stockholders' Date Description Debit Credit Assets Liabilities Equity Revenues Expenses June 2 Income Statement Net Revenues Expenses Income June 5: Purchased a computer system for $11,250. The agreement with the vendor requires a down payment of $2,100 with the balance due in 60 days. Journal Balance Sheet Income Stateme Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expenses June 5 Income Statement Net Revenues Expenses Income June 8: Signed a two-year promissory note at the bank and received cash of $18,400. Journal Balance Sheet Income Stateme Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expenses June 8 Income Statement Net Revenues Expenses Income June 15: Billed $12,150 to clients for the first half of June. Clients are billed twice a month for services performed during the month, and the bills are payable within ten days. Journal Balance Sheet Income Stater Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expens June 15 Income Statement Net Revenues Expenses = Income June 17: Paid a $810 bill from the local newspaper for advertising for the month of June. Journal Balance Sheet Income Statem Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expense June 17 Income Statement Net Revenues Expenses Income June 23: Received the amounts billed to clients for services performed during the first half of the month. Journal Balance Sheet Income Staten Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expens June 23 une 20. Dociod andmaidane olactric and water bill. The total amountie 500 Income Statement Net Revenues Expenses II Income June 28: Received and paid gas, electric, and water bills. The total amount is $2,590. Journal Balance Sheet Income Staten Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expense June 28 Income Statement Net Revenues Expenses = Income June 29: Received the landlord's bill for $2,310 for rent on the office space that Neveranerror leases. The bill is payable by the 10th of the following month. Journal Balance Sheet Income State Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expens June 29 Income Statement Net Revenues Expenses II Income June 30: Paid salaries and wages for June. The total amount is $5,860. Journal Balance Sheet Income Statem Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expense June 30 Income Statement Net Revenues Expenses Income June 30: Billed $18,770 to clients for the second half of June. Journal Balance Sheet Income Statem Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expense: June 30 Income Statement Net Revenues Expenses Income June 30: Declared and paid dividends in the amount of $4,950. Journal Balance Sheet Income State Stockholders' Date Description Debit Credit Assets Liabilities + Equity Revenues Expen: June 30 Income Statement Net Revenues Expenses Income 2. Prepare a trial balance at June 30. If an amount box does not require an entry, leave it blank. Neveranerror Inc. Trial Balance June 30 Debits Credits $ $ Totals $ 3a. Prepare the income statement for the month of June. Neveranerror Inc. Income Statement For the Month of June Expenses: $ $ 3b. Prepare the statement of retained earnings for the month of June. If an amount is zero, enter "0". Neveranerror Inc. Statement of Retained Earnings For the Month of June June 30 Assets Current assets: $ Total current assets $ Property, plant, and equipment: Total assets Liabilities and Stockholders' Equity Current liabilities: $ Long-term debt: Total liabilities Total stockholders' equity Total liabilities and stockholders' equity 4. From your reading of the financial statements for the first month, would you consider working at the company? Why? The company able to generate revenues and control costs. The profit margin was and current ratio was

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts