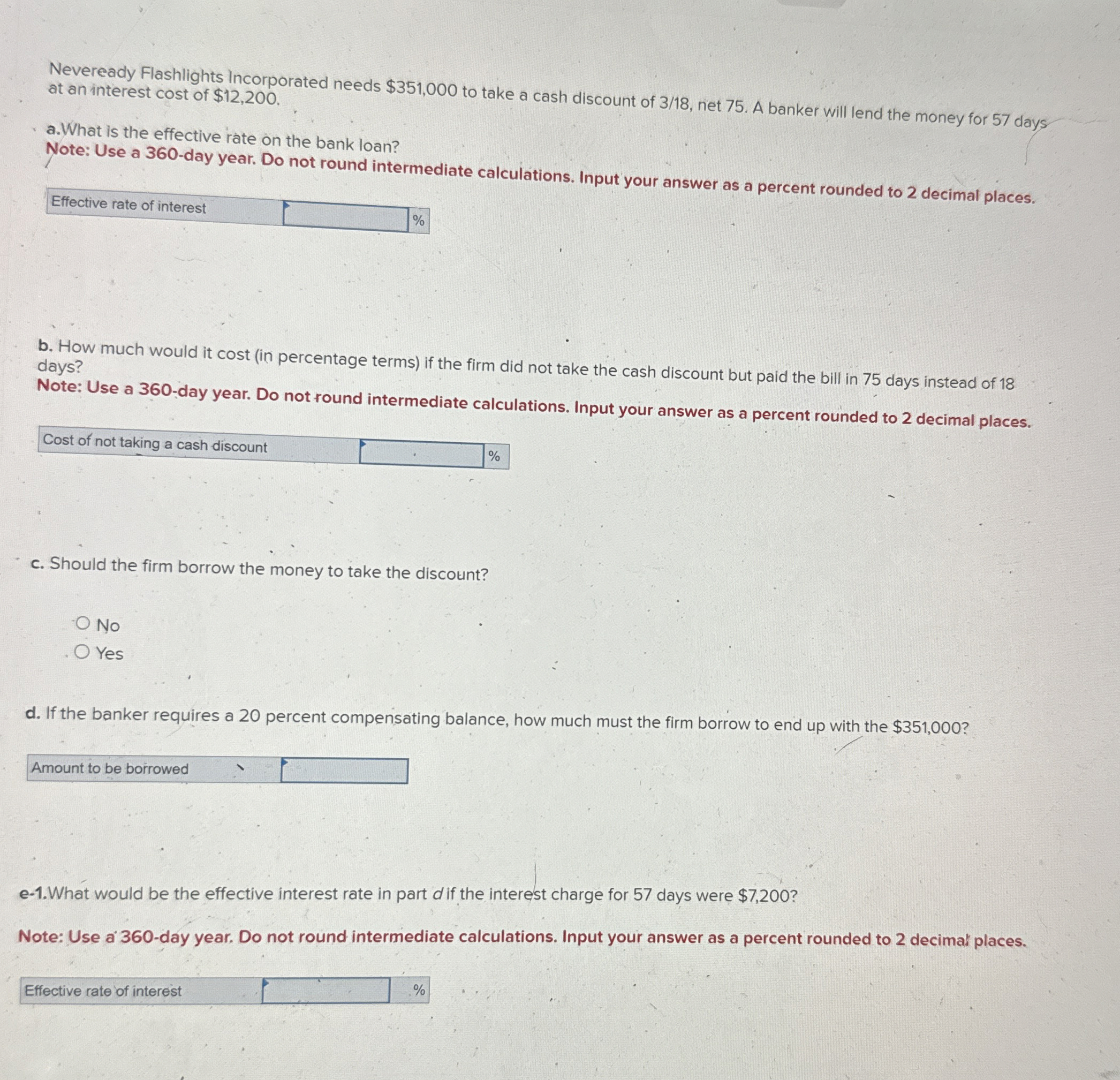

Question: Neveready Flashlights incorporated needs $ 3 5 1 , 0 0 0 to take a cash discount of 3 1 8 , net 7 5

Neveready Flashlights incorporated needs $ to take a cash discount of net A banker will lend the money for days

at an interest cost of $

a What is the effective rate on the bank loan?

Note: Use a day year. Do not round intermediate calculations. Input your answer as a percent rounded to decimal places.

Effective rate of interest

b How much would it cost in percentage terms if the firm did not take the cash discount but paid the bill in days instead of

days?

Note: Use a day year. Do not round intermediate calculations. Input your answer as a percent rounded to decimal places.

Cost of not taking a cash discount

c Should the firm borrow the money to take the discount?

No

No

Yes

d If the banker requires a percent compensating balance, how much must the firm borrow to end up with the $

Amount to be borrowed

e What would be the effective interest rate in part if the interest charge for days were $

Note: Use aday year. Do not round intermediate calculations. Input your answer as a percent rounded to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock