Question: New experts please avoid doing this question. Don't copy from chegg On January 1, 2018, Lots-Loot purchased a 25% interest in the common stock of

New experts please avoid doing this question. Don't copy from chegg

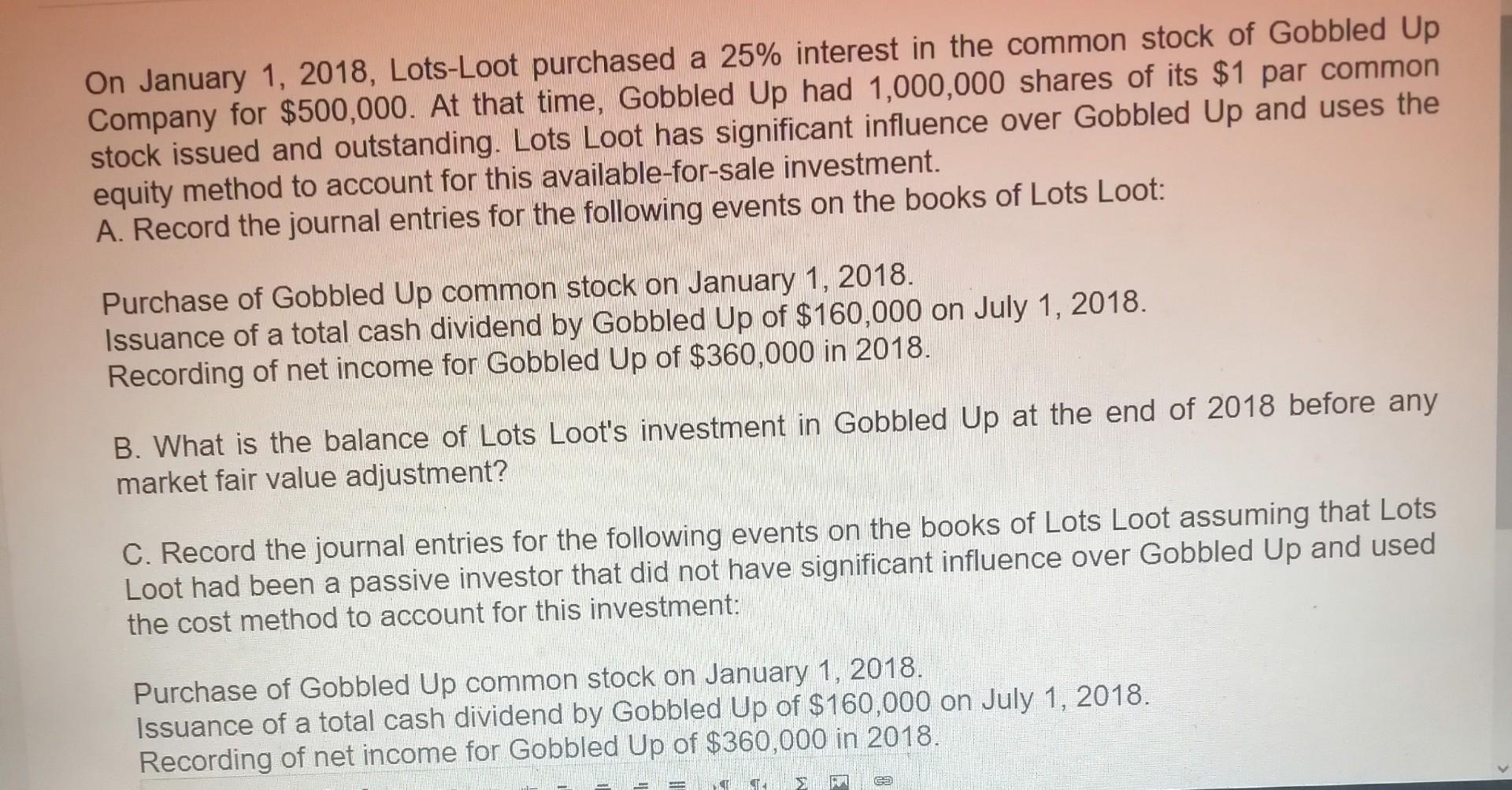

On January 1, 2018, Lots-Loot purchased a 25% interest in the common stock of Gobbled Up Company for $500,000. At that time, Gobbled Up had 1,000,000 shares of its $1 par common stock issued and outstanding. Lots Loot has significant influence over Gobbled Up and uses the equity method to account for this available-for-sale investment. A. Record the journal entries for the following events on the books of Lots Loot: Purchase of Gobbled Up common stock on January 1, 2018. Issuance of a total cash dividend by Gobbled Up of $160,000 on July 1, 2018. Recording of net income for Gobbled Up of $360,000 in 2018. B. What is the balance of Lots Loot's investment in Gobbled Up at the end of 2018 before any market fair value adjustment? C. Record the journal entries for the following events on the books of Lots Loot assuming that Lots Loot had been a passive investor that did not have significant influence over Gobbled Up and used the cost method to account for this investment: Purchase of Gobbled Up common stock on January 1, 2018. Issuance of a total cash dividend by Gobbled Up of $160,000 on July 1, 2018. Recording of net income for Gobbled Up of $360,000 in 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts