Question: New - Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $970,000, and

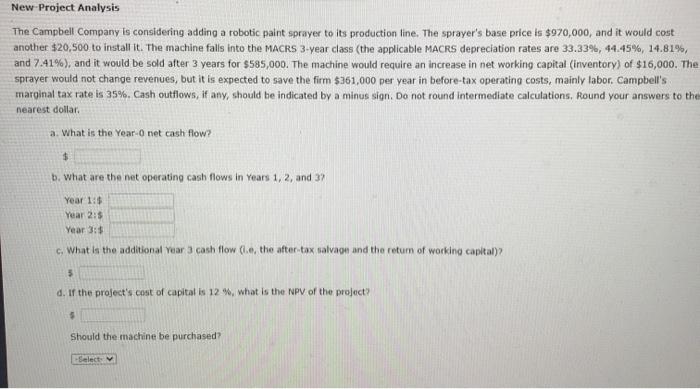

New - Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $970,000, and it would cost another $20,500 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after 3 years for $585,000. The machine would require an increase in net working capital (inventory) of $16,000. The sprayer would not change revenues, but it is expected to save the firm $361,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 35%. Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations, Round your answers to the nearest dollar a. What is the Year Onet cash flow? $ b. What are the net operating cash flows in Years 1, 2, and 3? Year 16 Year 2:5 Year 3:5 c. What is the additional Year 3 cash flow (le, the after tax salvagn and the retum of working capital) 5 d. If the project's cost of capital is 12%, what is the NPV of the project? 5 Should the machine be purchased? Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts