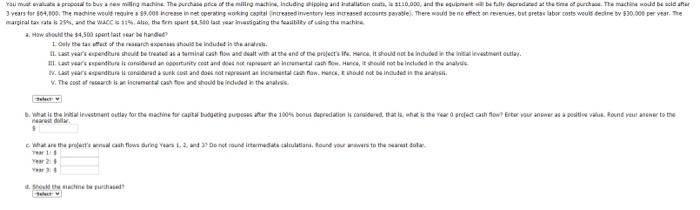

Question: New Project Analysis You must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation

You may propouts bus ning machine. The purchase tice of the machine indding plantina, 310.000, and the be fully decreased them of purch. The main would be cler 3 years to 564,100. The machine would require 9.00 rense in netrating king capital increase inventory less need accounts avable. There would be neelect on reserves, but aretac labor costs would tere by 530.000 per year. The arginal taxat is 254, and the WACC SA, the font suso last year wigating that in the machine 2. How shid the $4,500 spent faster what? Only the taste of the search should be inded in the 1. Last year's expenditure should be treated as a seminal cash flow and dealt with at the end of projects. Here it should not be induced in the initiatievement. Last year's gende is corded any cost and content conta com could not be induced in the are W. years expenditure candida sus cost and does not representata con ance, the nat Deinde in me V. The cost of his incremental car for a shodd be induced the analysis What is the investment outlay for the machine te capital dating sesatare 100% bonus depreciation is considered that is what the year project chow Ester your anser as a positiva, Bound your ance to the . Where the per cash flowers 1.2 tot found intermediate celular, found your wors to the eart to 1 Sachine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts