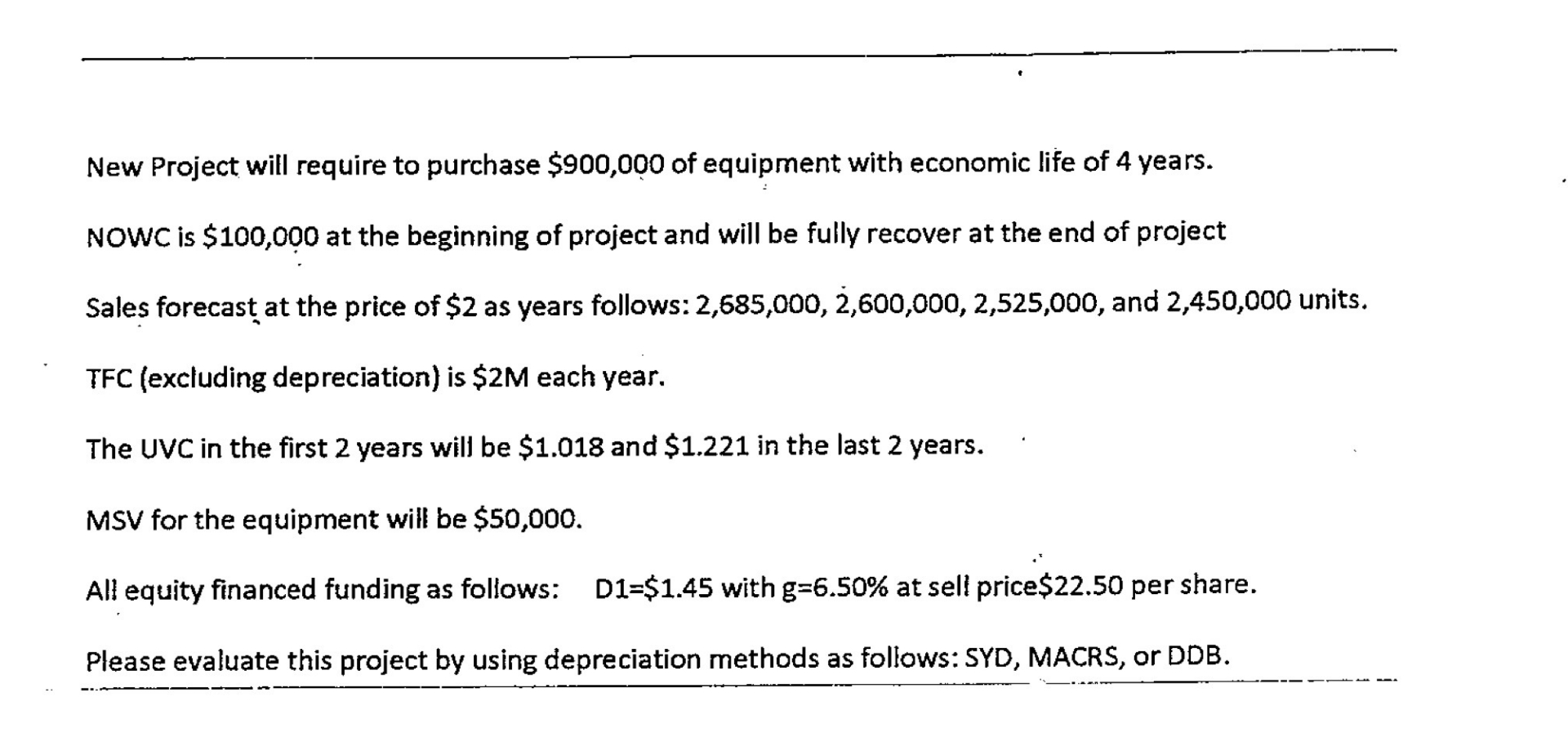

Question: New Project will require to purchase $ 9 0 0 , 0 0 0 of equipment with economic life of 4 years. NOWC is $

New Project will require to purchase $ of equipment with economic life of years.

NOWC is $ at the beginning of project and will be fully recover at the end of project

Sales forecast at the price of $ as years follows: and units.

TFC excluding depreciation is $ each year.

The UVC in the first years will be $ and $ in the last years.

MSV for the equipment will be $

All equity financed funding as follows: $ with at sell price $ per share.

Please evaluate this project by using depreciation methods as follows: SYD MACRS, or DDB

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock