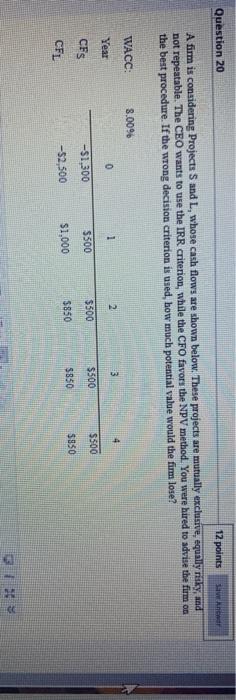

Question: new Question 20 12 points A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally

new Question 20 12 points A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise the firm on the best procedure. If the wrong decision criterion is used, how much potential value would the firm lose? WACC: 8.00% 0 2 1 Year 3 $500 $500 $500 5500 CFS -$1,300 -52,500 $850 $350 $950 CFL $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts