Question: New Ro... 12 . A+ A- A. A IE. . . . Pating2 g edigen Exhibit 1 A firm's abbreviated balance sheet along with additional

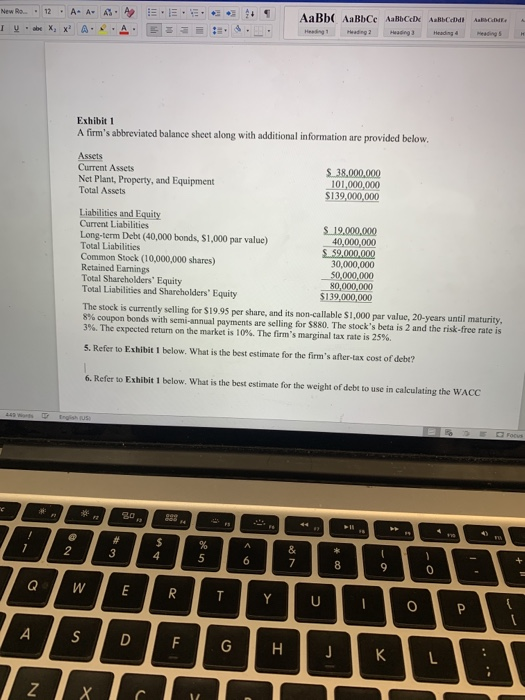

New Ro... 12 . A+ A- A. A IE. . . . Pating2 g edigen Exhibit 1 A firm's abbreviated balance sheet along with additional information are provided below. Assets Current Assets Net Plant, Property, and Equipment Total Assets S 38.000.000 101,000,000 $139,000,000 Liabilities and Equity Current Liabilities $ 19,000,000 Long-term Debt (40.000 bonds, $1,000 par value) 40,000,000 Total Liabilities 59.000.000 Common Stock (10,000,000 shares) 30,000,000 Retained Earnings 50,000,000 Total Shareholders' Equity 80,000.000 Total Liabilities and Shareholders' Equity $139,000,000 The stock is currently selling for $19.95 per share, and its non-callable $1,000 par value, 20-years until maturity, 8% coupon bonds with semi-annual payments are selling for $880. The stock's beta is 2 and the risk-free rate is 3%. The expected return on the market is 10%. The firm's marginal tax rate is 25% 5. Refer to Exhibit I below. What is the best estimate for the firm's after-tax cost of debt? 6. Refer to Exhibit I below. What is the best estimate for the weight of debt to use in calculating the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts