Question: New-Ink, Inc. has just started operations in Lethbridge and expects super normal operating growth in its first two years of operations. Calculate the intrinsic (theoretical)

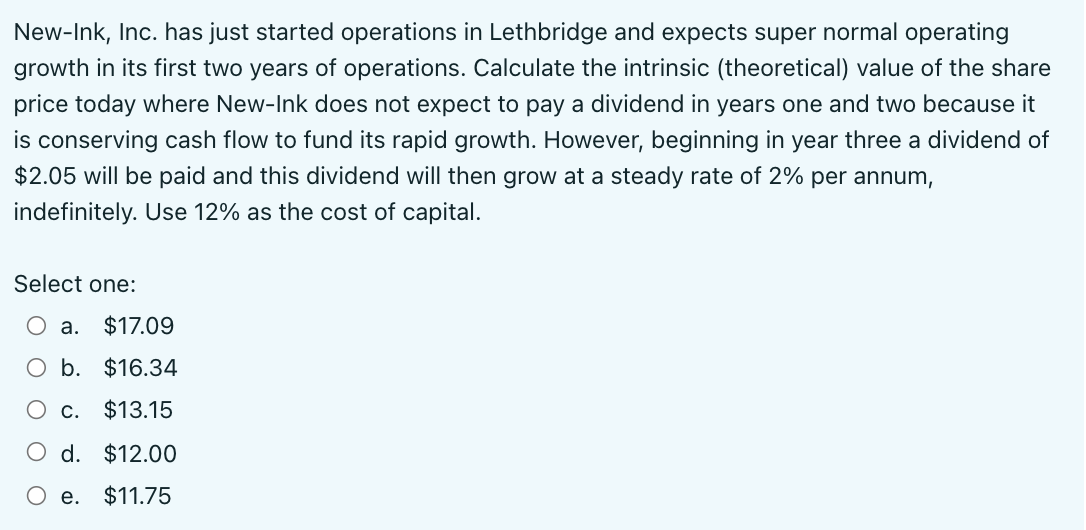

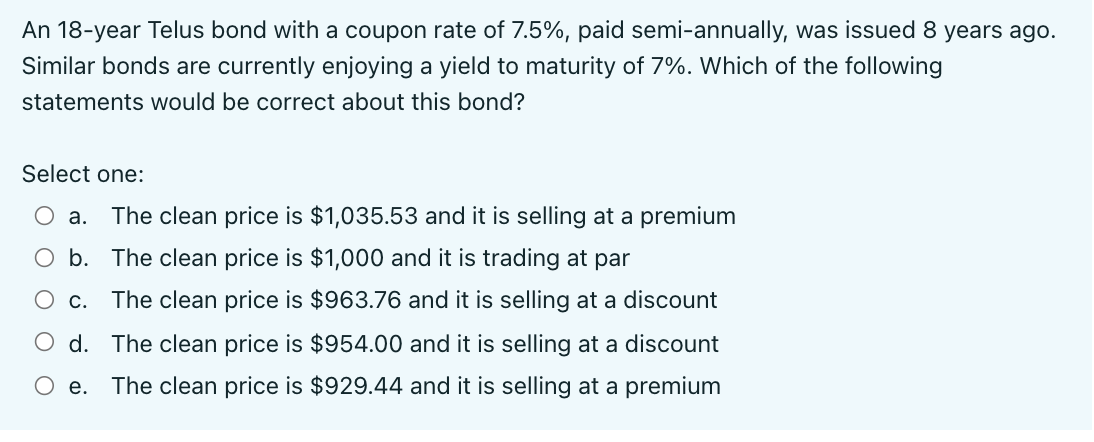

New-Ink, Inc. has just started operations in Lethbridge and expects super normal operating growth in its first two years of operations. Calculate the intrinsic (theoretical) value of the share price today where New-Ink does not expect to pay a dividend in years one and two because it is conserving cash flow to fund its rapid growth. However, beginning in year three a dividend of $2.05 will be paid and this dividend will then grow at a steady rate of 2% per annum, indefinitely. Use 12% as the cost of capital. Select one: O a. $17.09 O b. $16.34 O c. $13.15 O d. $12.00 e. $11.75 An 18-year Telus bond with a coupon rate of 7.5%, paid semi-annually, was issued 8 years ago. Similar bonds are currently enjoying a yield to maturity of 7%. Which of the following statements would be correct about this bond? Select one: O a. The clean price is $1,035.53 and it is selling at a premium O b. The clean price is $1,000 and it is trading at par O c. The clean price is $963.76 and it is selling at a discount O d. The clean price is $954.00 and it is selling at a discount O e. The clean price is $929.44 and it is selling at a premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts