Question: Next, construct the balance sheet for EconDisaster.com for December 31, 2008. The company had no assets at the beginning of the year. The owners contributed

Next, construct the balance sheet for EconDisaster.com for December 31, 2008. The company had no assets at the beginning of the year. The owners contributed $10,000 of start-up capital and obtained common stock. Net income and retained earnings can be calculated from question 7.

Reference question 7

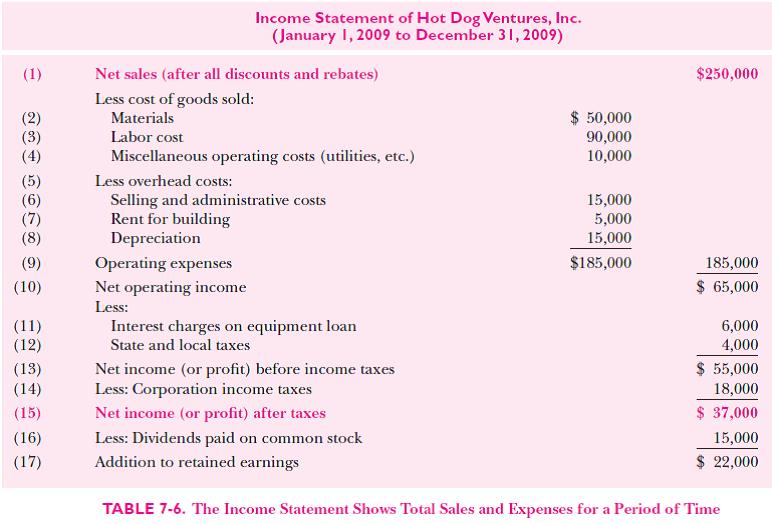

In 2008, a fictitious software company named EconDisaster.com sold $7000 worth of a game called “Global Financial Meltdown.” The company had salaries of $1000, rent of $500, and electricity use of $500, and it purchased a computer for $5000. The company uses straight-line depreciation with a lifetime of 5 years (this means that depreciation is calculated as the historical cost divided by the lifetime). It pays a corporation tax of 25 percent on profits and paid no dividends. Construct its income statement for 2008 based on Table 7-6.

Reference Table 7-6

Income Statement of Hot Dog Ventures, Inc. (January I, 2009 to December 31, 2009) (1) Net sales (after all discounts and rebates) $250,000 Less cost of goods sold: Materials (2) (3) (4) $ 50,000 90,000 10,000 Labor cost Miscellaneous operating costs (utilities, etc.) (5) (6) (7) (8) Less overhead costs: Selling and administrative costs Rent for building Depreciation 15,000 5,000 15,000 (9) Operating expenses $185,000 185,000 (10) Net operating income $ 65,000 Less: (11) (12) 6,000 4,000 Interest charges on equipment loan State and local taxes $ 55,000 (13) (14) Net income (or profit) before income taxes Less: Corporation income taxes 18,000 (15) Net income (or profit) after taxes $ 37,000 (16) Less: Dividends paid on common stock 15,000 (17) Addition to retained earnings $ 22,000 TABLE 7-6. The Income Statement Shows Total Sales and Expenses for a Period of Time

Step by Step Solution

3.55 Rating (173 Votes )

There are 3 Steps involved in it

The balance sheet is a positional statement which shows t... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635e29ffb2964_181994.pdf

180 KBs PDF File

635e29ffb2964_181994.docx

120 KBs Word File