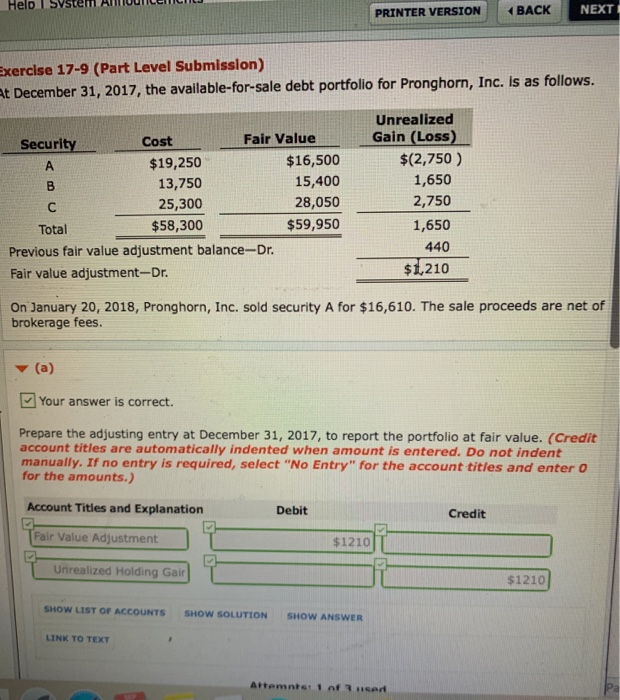

Question: NEXT Held 1 System PRINTER VERSION BACK exercise 17-9 (Part Level Submission) t December 31, 2017, the available-for-sale debt portfolio for Pronghorn, Inc. is as

NEXT Held 1 System PRINTER VERSION BACK exercise 17-9 (Part Level Submission) t December 31, 2017, the available-for-sale debt portfolio for Pronghorn, Inc. is as follows. Security Cost Fair Value $19,250 $16,500 13,750 15,400 25,300 28,050 $59,950 $58,300 Total Previous fair value adjustment balance-Dr. Fair value adjustment-Dr. Unrealized Gain (Loss) $(2,750 ) 1,650 2,750 1,650 440 $1,210 On January 20, 2018, Pronghorn, Inc. sold security A for $16,610. The sale proceeds are net of brokerage fees. (a) Your answer is correct. Prepare the adjusting entry at December 31, 2017, to report the portfolio at fair value. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Fair Value Adjustment Unrealized Holding GairT $1210 SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER LINK TO TEXT em (b) Show the balance sheet presentation of the investment-related accounts at December 31, 2017. (Do not leave any answer field blank. Enter o for amounts.) PRONGHORN, INC Balance Sheet > SHOW LIST OF ACCOUNTS LINK TO TEXT Attempts: 0 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts