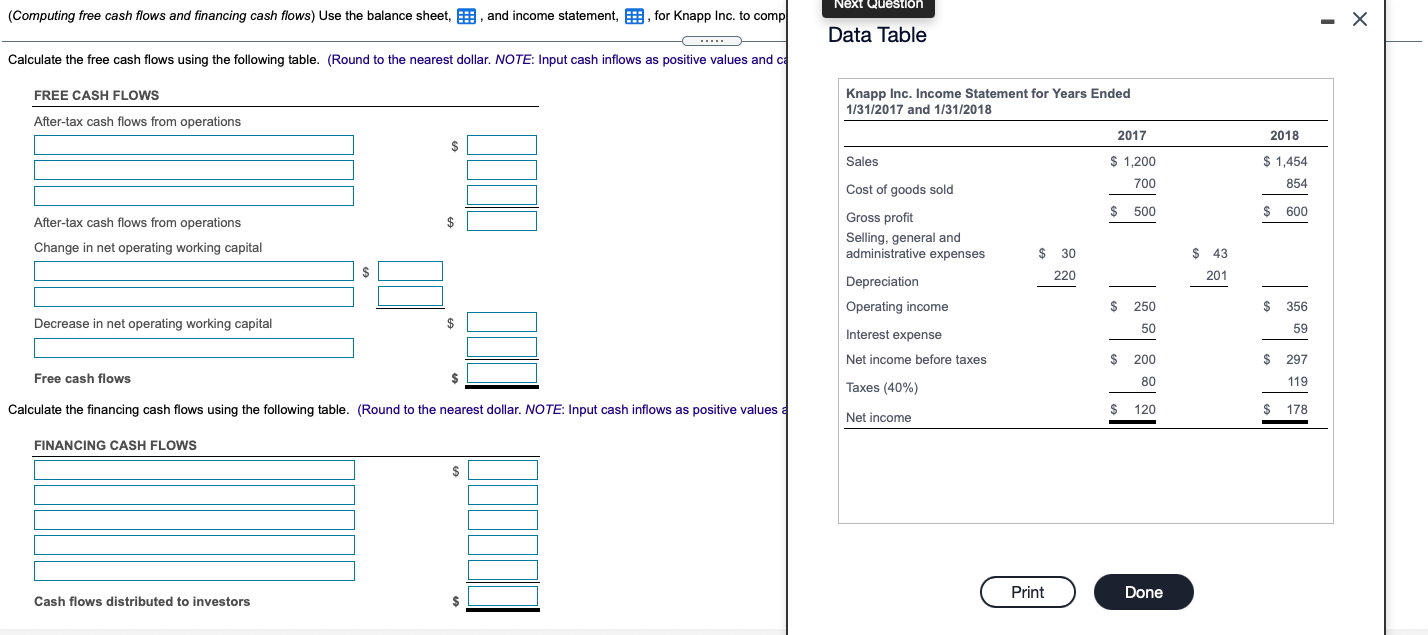

Question: Next Question (Computing free cash flows and financing cash flows) Use the balance sheet, B, and income statement, 5 , for Knapp Inc. to comp

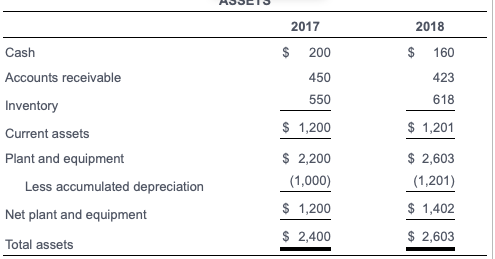

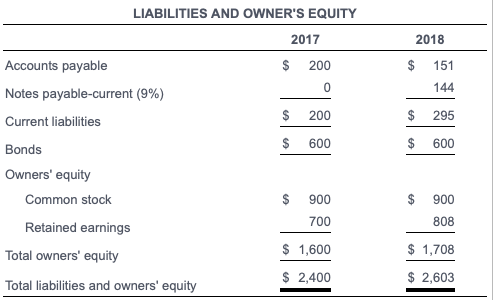

Next Question (Computing free cash flows and financing cash flows) Use the balance sheet, B, and income statement, 5 , for Knapp Inc. to comp !!! - X Data Table Calculate the free cash flows using the following table. (Round to the nearest dollar. NOTE: Input cash inflows as positive values and ca FREE CASH FLOWS Knapp Inc. Income Statement for Years Ended 1/31/2017 and 1/31/2018 After-tax cash flows from operations 2017 2018 $ Sales $ 1,200 700 $ 1,454 854 Cost of goods sold $ 500 $ 600 After-tax cash flows from operations $ Gross profit Selling, general and administrative expenses Change in net operating working capital $ 43 $ 30 220 201 Depreciation Operating income $ 356 Decrease in net operating working capital $ 250 50 $ 59 Interest expense Net income before taxes $ 200 $ 297 Free cash flows $ 80 119 Taxes (40%) Calculate the financing cash flows using the following table. (Round to the nearest dollar. NOTE: Input cash inflows as positive values $ 120 $ 178 Net income FINANCING CASH FLOWS $ Print Done Cash flows distributed to investors $ 2017 2018 $ 200 $ 160 Cash Accounts receivable 450 423 618 550 $ 1,200 $ 1,201 Inventory Current assets Plant and equipment Less accumulated depreciation $ 2,200 (1,000) $ 1,200 $ 2,603 (1,201) $ 1,402 Net plant and equipment Total assets $ 2,400 $ 2,603 2018 $ 151 0 144 295 LIABILITIES AND OWNER'S EQUITY 2017 Accounts payable $ 200 Notes payable-current (9%) $ 200 Current liabilities $ 600 Bonds Owners' equity Common stock $ 900 700 Retained earnings Total owners' equity $ 1,600 $ 2,400 Total liabilities and owners' equity $ 600 $ 900 808 $ 1,708 $ 2,603

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts