Question: next steps please y Avelar 4:51 PM Homework: Chapter 11 Homework Save Score: 0.67 of 2 pts 6 of 6 (8 complete) HW Score: 40.48%,

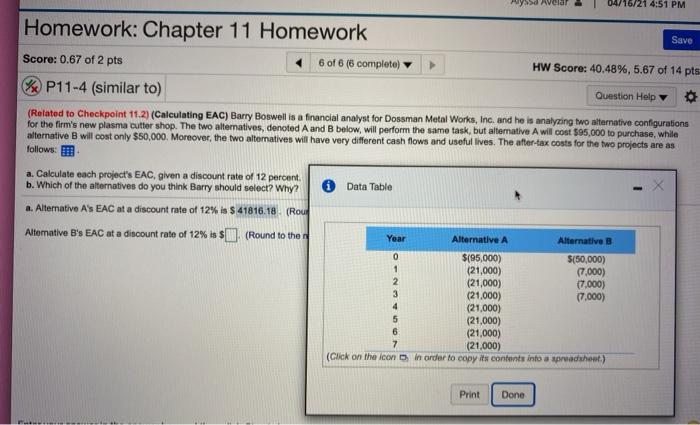

y Avelar 4:51 PM Homework: Chapter 11 Homework Save Score: 0.67 of 2 pts 6 of 6 (8 complete) HW Score: 40.48%, 5.67 of 14 pts P11-4 (similar to) Question Help (Related to Checkpoint 11.2) (Calculating EAC) Barry Boswell is a financial analyst for Dossman Metal Works, Inc. and he is analyzing two alternative configurations for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $95,000 to purchase, while alternative B will cost only $50,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as follows: a. Calculate each project's EAC, given a discount rate of 12 percent b. Which of the alternatives do you think Barry should select? Why? Data Table a. Alternative A's EAC at a discount rate of 12% is S 41816.18. (Rou Alternative B's EAC at a discount rate of 12% is $11. (Round to the Year Alternative A Alternative B 0 $(95,000) $(50,000) (21,000) (7,000) (21,000) (7.000) 3 (21,000) (7.000) 4 (21,000) 5 (21,000) 6 (21,000) 7 (21,000) (Click on the icon in order to copy its contents into a spreadsheet.) 1 2. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts