Question: Next year Windsor Mechanical Inc.'s EPS is expected to be $3. The firm is not expected to pay any dividends for the next four years.

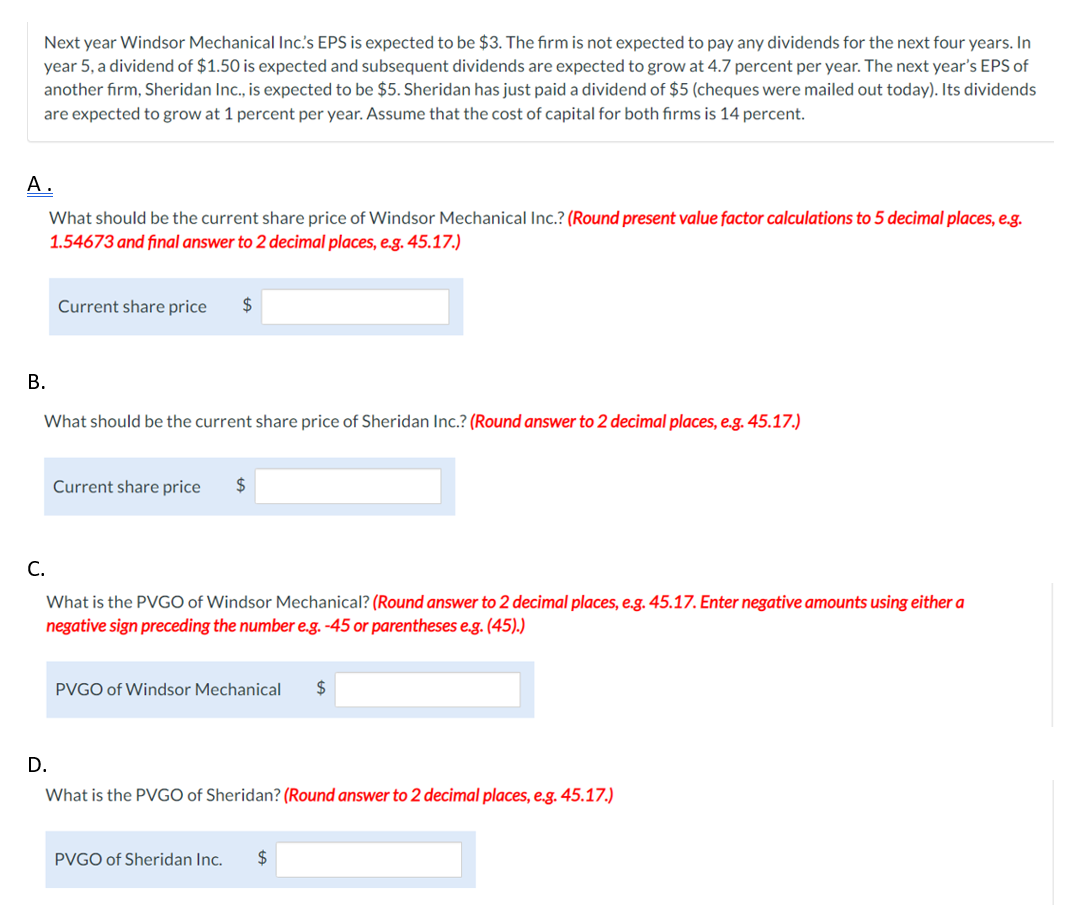

Next year Windsor Mechanical Inc.'s EPS is expected to be $3. The firm is not expected to pay any dividends for the next four years. In year 5 , a dividend of $1.50 is expected and subsequent dividends are expected to grow at 4.7 percent per year. The next year's EPS of another firm, Sheridan Inc., is expected to be $5. Sheridan has just paid a dividend of $5 (cheques were mailed out today). Its dividends are expected to grow at 1 percent per year. Assume that the cost of capital for both firms is 14 percent. A. What should be the current share price of Windsor Mechanical Inc.? (Round present value factor calculations to 5 decimal places, e.g. 1.54673 and final answer to 2 decimal places, e.g. 45.17.) Current share price $ B. What should be the current share price of Sheridan Inc.? (Round answer to 2 decimal places, e.g. 45.17.) Current share price $ C. What is the PVGO of Windsor Mechanical? (Round answer to 2 decimal places, e.g. 45.17. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) PVGO of Windsor Mechanical $ D. What is the PVGO of Sheridan? (Round answer to 2 decimal places, e.g. 45.17.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts