Question: ng expense transactions LO3,5 exercise 2-8 Analyzing and journalizing expense transactions the following transactions a Sharma owns and operates a yoga studio, Green Yoga. Escaminet

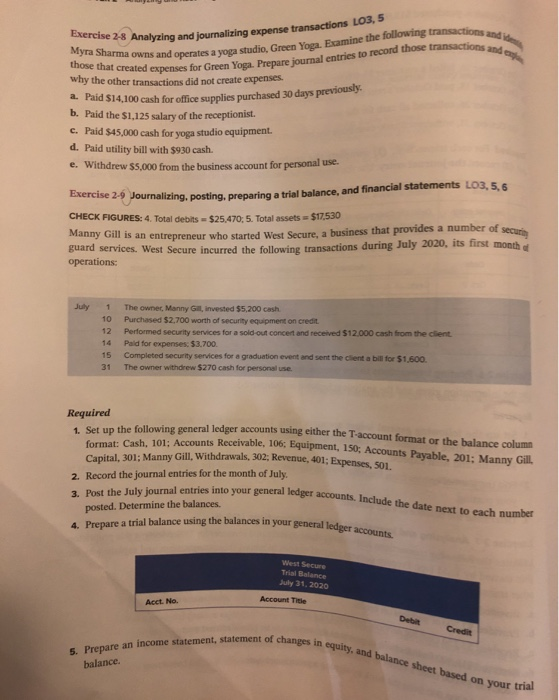

ng expense transactions LO3,5 exercise 2-8 Analyzing and journalizing expense transactions the following transactions a Sharma owns and operates a yoga studio, Green Yoga. Escaminet those that created expenses for the created expenses for Green Yoga. Prepare journal entries to record those transactions as why the other transactions did not create expenses. a. Paid $14,100 cash for office supplies purchased 30 days previously. b. Paid the $1,125 salary of the receptionist. c. Paid $45,000 cash for yoga studio equipment. d. Paid utility bill with $930 cash. e. Withdrew $5,000 from the business account for personal use. ise 2-9 Journalizing. posting, preparing a trial balance, and financial statements LO3,5,6 CHECK FIGURES: 4. Total debits = $25.470 5. Total assets = $17.530 Manny Gill is an entrepreneur who started West Secure a business that provides a number of se guard services. West Secure incurred the following transactions during July 2020, its first month operations: July 1 10 12 14 15 31 The owner, Manny Gill, invested $5,200 cash Purchased $2,700 worth of security equipment on credit Performed security services for a sold-out concert and received $12.000 cash from the client Pald for expenses: 53.700 Completed security services for a graduation event and sent the client a bill for $1.500 The owner withdrew $270 cash for personal use. Required 1. Set up the following general ledger accounts us following general ledger accounts using either the T-account format or the balance column format: Cash, 101: Accounts Receivable, 106; Equipment, 150; Account Equipment, 150, Accounts Payable, 201: Manny Gill, Capital, 301: Manny Gill, Withdrawals, 302: Revenue, 401; Expenses 50 2. Record the journal entries for the month of July 3. Post the July journal entries into your general leder posted. Determine the balances. 4. Prepare a trial balance using the balances in your general leder into your general ledger accounts. Include the date next to each number in your general ledger accounts. West Secure Trial Balance July 31, 2020 Acct. No. Account Title Debit Credit of changes in equity, and balance sheet based on your tra 5. Prepare an income statement, statement of ch balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts