Question: ng payment across the globe; providing risk-mitigation; ofering a range ot ting payment across the globe; assessing risk; offering a range of financing financing options

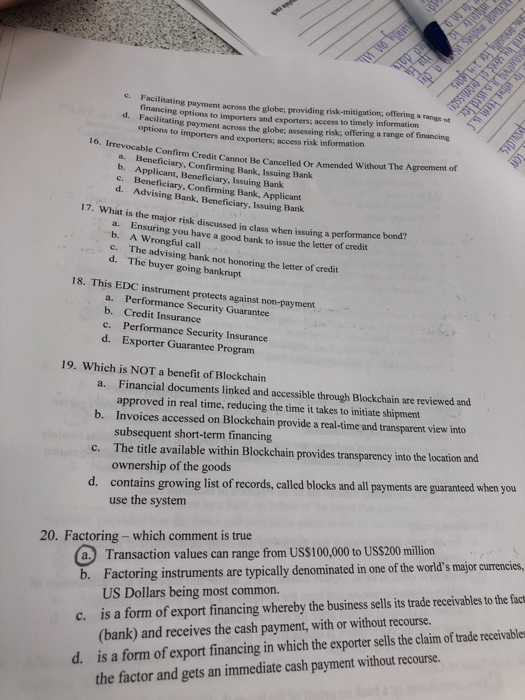

ng payment across the globe; providing risk-mitigation; ofering a range ot ting payment across the globe; assessing risk; offering a range of financing financing options to importers and exporters; access to timely information d. Facilitating options to importers and exporters; access risk i 16. Irrevocable Confirm Credit Cannot Be Cancelled Or Amended Without The Agreement of a. Beneficiary, Confirming Bank, Issuing Bank b. Applicant, Beneficiary, Issuing Bank c. Beneficiary, Confirming Bank, Applicant d. Advising Bank, Beneficiary, Issuing Bank 17. W hat is the major risk discussed in class when issuing a performance bond? a. Ensuring you have a good bank to issue the letter of credit b. A Wrongful call c. The advising bank not honoring the letter of credit d. The buyer going bankrupt 18. This EDC instrument protects against non-payment a. Performance Security Guarantee b. Credit Insurance c. Performance Security Insurance d. Exporter Guarantee Program 19. Which is NOT a benefit of Blockchain Financial documents linked and accessible through Blockchain are reviewed and approved in real time, reducing the time it takes to initiate shipment Invoices accessed on Blockchain provide a real-time and transparent view into subsequent short-term financing The title available within Blockchain provides transparency into the location and ownership of the goods contains growing list of records, called blocks and all payments are guaranteed when you use the system a. b. c. d. 20. Factoring-which comment is true Factoring instruments are typically denominated in one of the world's major currencies US Dollars being most common. is a form of export financing whereby the business sells its trade receivables to the fact (bank) and receives the cash payment, with or without recourse is a form of export financing in which the exporter sells the claim of trade receivable the factor and gets an immediate cash payment without recourse. a. Transaction values can range from US$100,000 to US$200 million c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts