Question: Nicholas and Whitney Clement case Need help! 11. How much more money must Nicholas and Whitney save to meet their emergency fund objective? 12. If

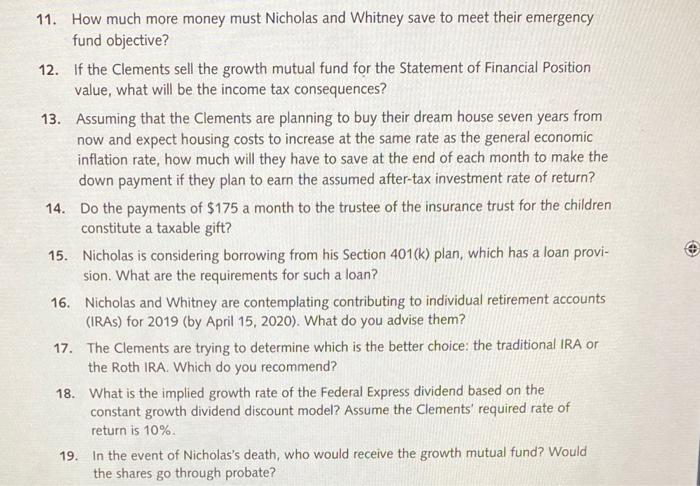

11. How much more money must Nicholas and Whitney save to meet their emergency fund objective? 12. If the Clements sell the growth mutual fund for the Statement of Financial Position value, what will be the income tax consequences? 13. Assuming that the Clements are planning to buy their dream house seven years from now and expect housing costs to increase at the same rate as the general economic inflation rate, how much will they have to save at the end of each month to make the down payment if they plan to earn the assumed after-tax investment rate of return? 14. Do the payments of $175 a month to the trustee of the insurance trust for the children constitute a taxable gift? 15. Nicholas is considering borrowing from his Section 401(k) plan, which has a loan provision. What are the requirements for such a loan? 16. Nicholas and Whitney are contemplating contributing to individual retirement accounts (IRAs) for 2019 (by April 15, 2020). What do you advise them? 17. The Clements are trying to determine which is the better choice: the traditional IRA or the Roth IRA. Which do you recommend? 18. What is the implied growth rate of the Federal Express dividend based on the constant growth dividend discount model? Assume the Clements' required rate of return is 10%. 19. In the event of Nicholas's death, who would receive the growth mutual fund? Would the shares go through probate? 11. How much more money must Nicholas and Whitney save to meet their emergency fund objective? 12. If the Clements sell the growth mutual fund for the Statement of Financial Position value, what will be the income tax consequences? 13. Assuming that the Clements are planning to buy their dream house seven years from now and expect housing costs to increase at the same rate as the general economic inflation rate, how much will they have to save at the end of each month to make the down payment if they plan to earn the assumed after-tax investment rate of return? 14. Do the payments of $175 a month to the trustee of the insurance trust for the children constitute a taxable gift? 15. Nicholas is considering borrowing from his Section 401(k) plan, which has a loan provision. What are the requirements for such a loan? 16. Nicholas and Whitney are contemplating contributing to individual retirement accounts (IRAs) for 2019 (by April 15, 2020). What do you advise them? 17. The Clements are trying to determine which is the better choice: the traditional IRA or the Roth IRA. Which do you recommend? 18. What is the implied growth rate of the Federal Express dividend based on the constant growth dividend discount model? Assume the Clements' required rate of return is 10%. 19. In the event of Nicholas's death, who would receive the growth mutual fund? Would the shares go through probate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts