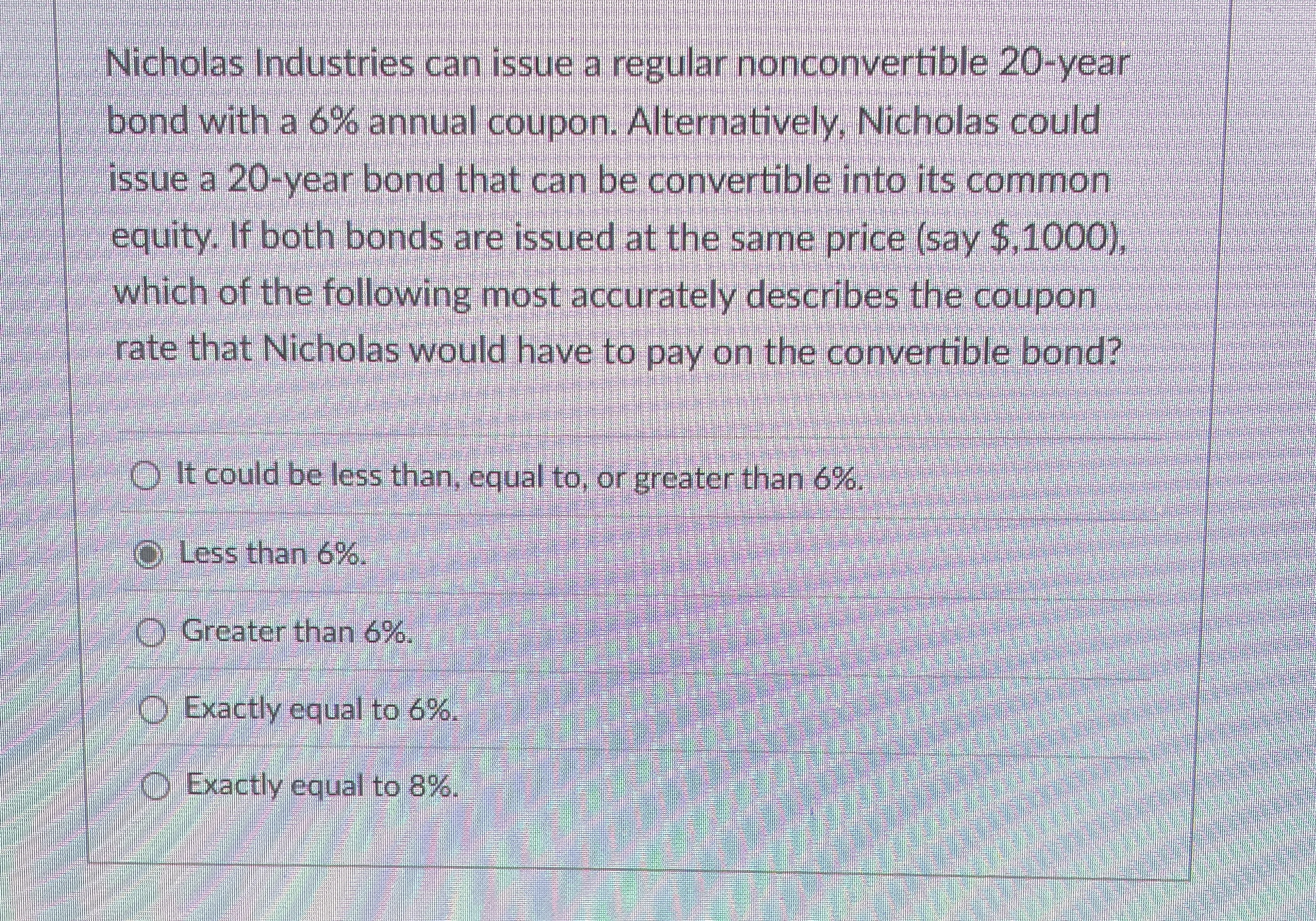

Question: Nicholas Industries can issue a regular nonconvertible 2 0 - year bond with a 6 % annual coupon. Alternatively, Nicholas could issue a 2 0

Nicholas Industries can issue a regular nonconvertible year

bond with a annual coupon. Alternatively, Nicholas could

issue a year bond that can be convertible into its common

equity. If both bonds are issued at the same price say $

which of the following most accurately describes the coupon

rate that Nicholas would have to pay on the convertible bond?

It could be less than, equal to or greater than

Less than

Greater than

Exactly equal to

Exactly equal to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock