Question: + nifica horizontal y vertical X C Solved: On January 1, 2011, Phoe X fundamentals-of-advanced-accounting-Sth-edition-chapter-3-problem-10P-solution-9780078025396 Binance Launchpad... Top 50 Cryptocurre... 7 0.67733 FET/USDT... Mi unidad

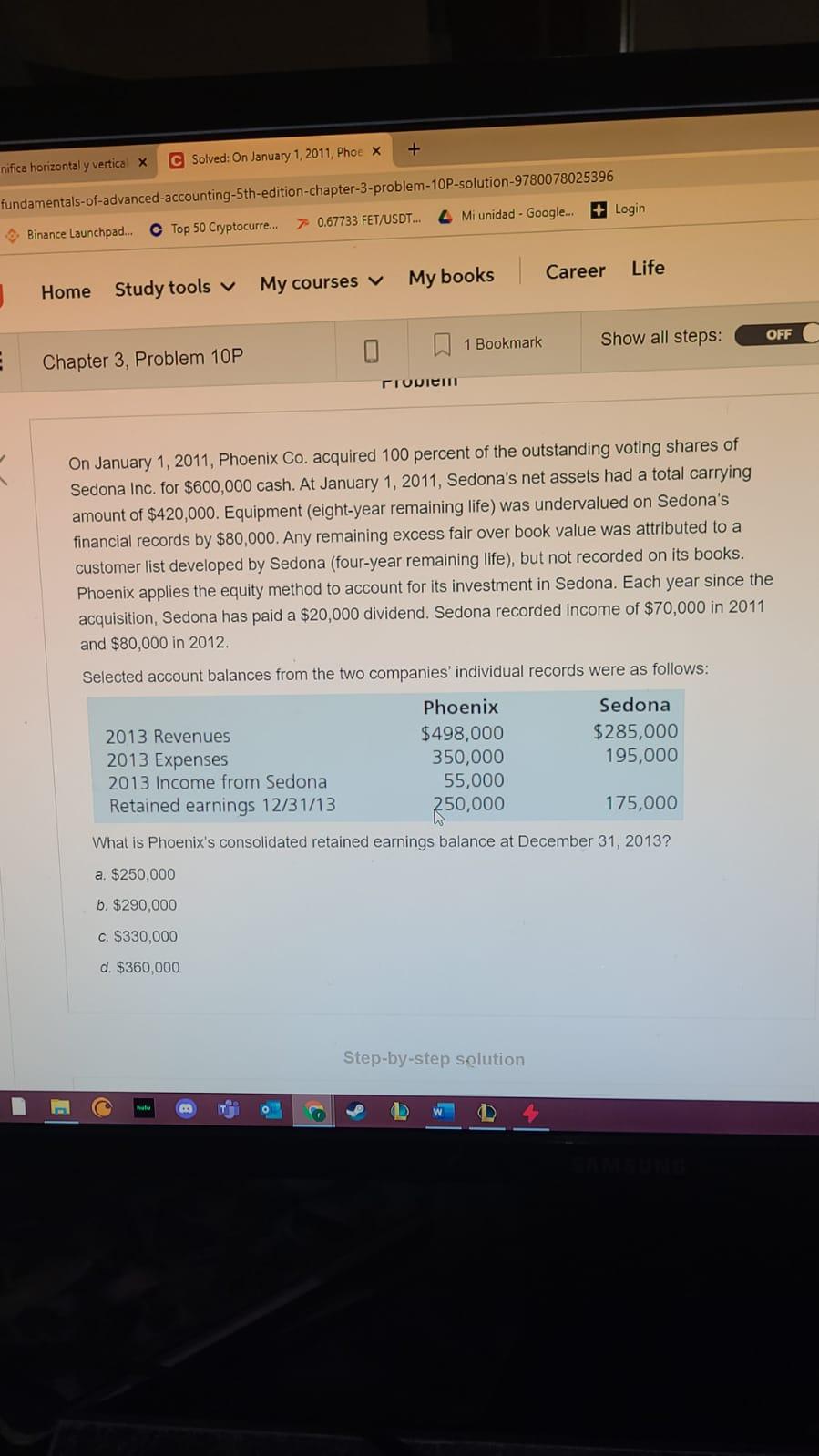

+ nifica horizontal y vertical X C Solved: On January 1, 2011, Phoe X fundamentals-of-advanced-accounting-Sth-edition-chapter-3-problem-10P-solution-9780078025396 Binance Launchpad... Top 50 Cryptocurre... 7 0.67733 FET/USDT... Mi unidad - Google... + Login Career Life My books Home My courses J Study tools v OFF 1 Bookmark Show all steps: Chapter 3, Problem 10P On January 1, 2011, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc. for $600,000 cash. At January 1, 2011, Sedona's net assets had a total carrying amount of $420,000. Equipment (eight-year remaining life) was undervalued on Sedona's financial records by $80,000. Any remaining excess fair over book value was attributed to a customer list developed by Sedona (four-year remaining life), but not recorded on its books. Phoenix applies the equity method to account for its investment in Sedona. Each year since the acquisition, Sedona has paid a $20,000 dividend. Sedona recorded income of $70,000 in 2011 and $80,000 in 2012. Selected account balances from the two companies' individual records were as follows: Phoenix Sedona 2013 Revenues $498,000 $285,000 2013 Expenses 350,000 195,000 2013 Income from Sedona 55,000 Retained earnings 12/31/13 175,000 250,000 What is Phoenix's consolidated retained earnings balance at December 31, 2013? a. $250,000 b. $290,000 C. $330,000 d. $360,000 Step-by-step solution W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts