Question: Nike Analysis Using the Nike balance sheet and income statement located in Brightspace, compute the following ratios for both 2020 and 2019: 1. Current ratio

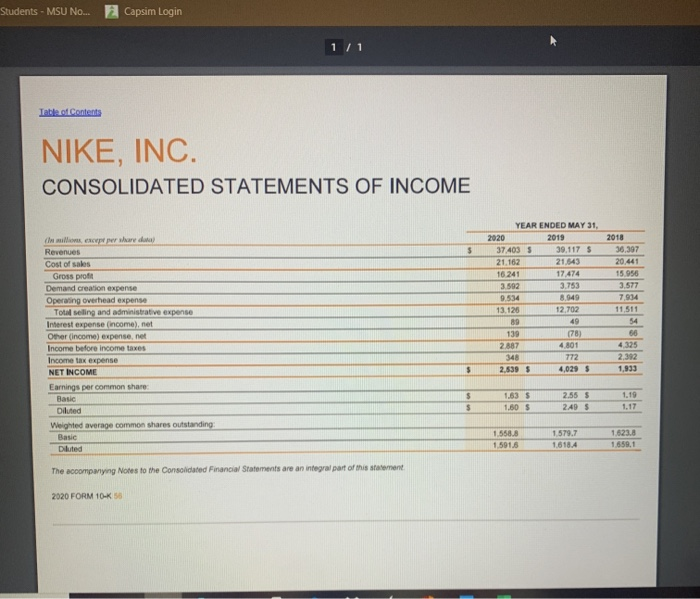

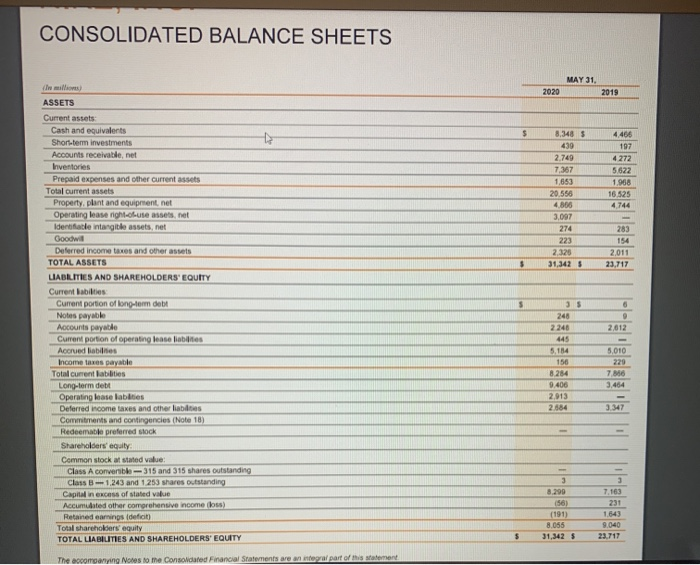

Nike Analysis Using the Nike balance sheet and income statement located in Brightspace, compute the following ratios for both 2020 and 2019: 1. Current ratio 2. Acid-test ratio I 3. Debt to equity ratio 4. Times interest earned Was there any ratio that changed dramatically from 2019 to 2020? What factor(s) do you think could have contributed to this change? Students - MSU No... Capsim Login 1/1 Table of Contents NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME $ Revenues Cost of sales Gross pro Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense.net Income before income taxes Income tax expense NET INCOME Earnings per common share Basic Diluted Weighted average common shares outstanding: YEAR ENDED MAY 31, 2020 2019 37 403 5 39.117 S 21.162 21.543 16.241 17.474 3.592 3.753 9.534 8.949 13.126 12.702 89 49 139 (78) 2.887 4801 348 772 2,539 5 4,029 $ 2018 36.397 20.441 15.956 3.577 7,934 11,511 54 66 4.325 2.392 1,933 $ $ $ 1.63 $ 1.60S 2.55$ 2.495 1.19 1.17 15588 1.591.6 1.579.7 1.618.4 1.823.8 1 659.1 Diluted The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 2020 FORM 10-K 58 CONSOLIDATED BALANCE SHEETS MAY 31, 2020 2019 $ 8,348 $ 439 2.749 7,367 1,653 20.556 4.806 3,097 274 223 2.325 31,3425 4.464 197 4272 5622 1.968 16.525 4744 283 154 2,011 23,717 $ $ 6 ASSETS Current assets Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Operating lease rightoute assets, net Identifiable intangible assets, net Goodwill Deferred income taxes and other assets TOTAL ASSETS UABILITIES AND SHAREHOLDERS' EQUITY Current abilities Current portion of long-term debit Notes payable Accounts payable Current portion of operating lease fiabilities Accrued liabilities Income taxes payable Total current abilities Long-term dett Operating lase labities Deferred income taxes and other labies Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity Common stock at stated value Class A convertible-315 and 315 shares outstanding Class B-1.243 and 1253 shares outstanding Capital in excess of stated value Accumulated other comprehensive income foss) Retained earnings. ideft Total shareholders equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 2,612 35 248 2248 445 5,184 156 8284 9.406 2.913 2.884 5,010 220 7.840 3,464 3.347 3 (191) 8,055 31,342 5 231 1.643 9.040 23.717 5 The accompanying Notes to the Consolidated Financial Statements are on tegral part of this statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts