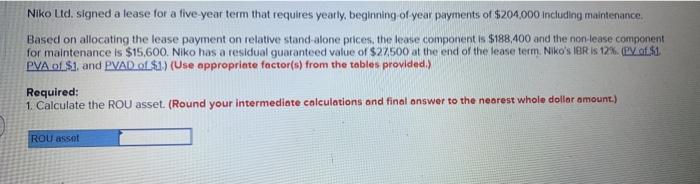

Question: Niko Lid, signed a lease for a five-year term that requires yearly, beginning of year payments of $204.000 including maintenance Based on allocating the lease

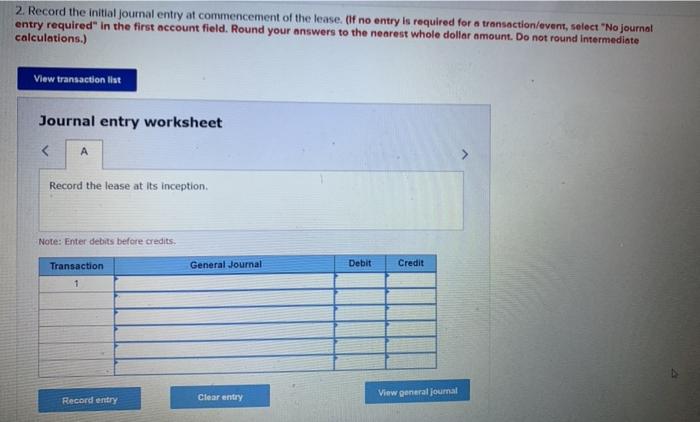

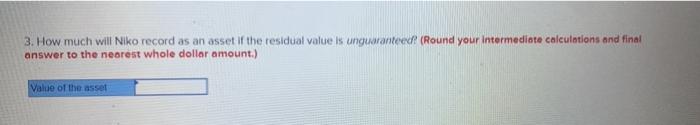

Niko Lid, signed a lease for a five-year term that requires yearly, beginning of year payments of $204.000 including maintenance Based on allocating the lease payment on relative stand-alone prices, the lease component is $188.400 and the non lease component for maintenance is $15,600. Niko has a residual guaranteed value of $27500 at the end of the lease term. Niko's IBR is 12%. (PV_of.$1. PVA of $1, and PVAD OLS1) (Use appropriate factor(s) from the tables provided) Required: 1. Calculate the ROU asset. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) ROU assot 2. Record the initial journal entry at commencement of the lease. (if no entry is required for a transaction/event, select "No journal entry required in the first account field. Round your answers to the nearest whole dollar amount. Do not round intermediate calculations.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts