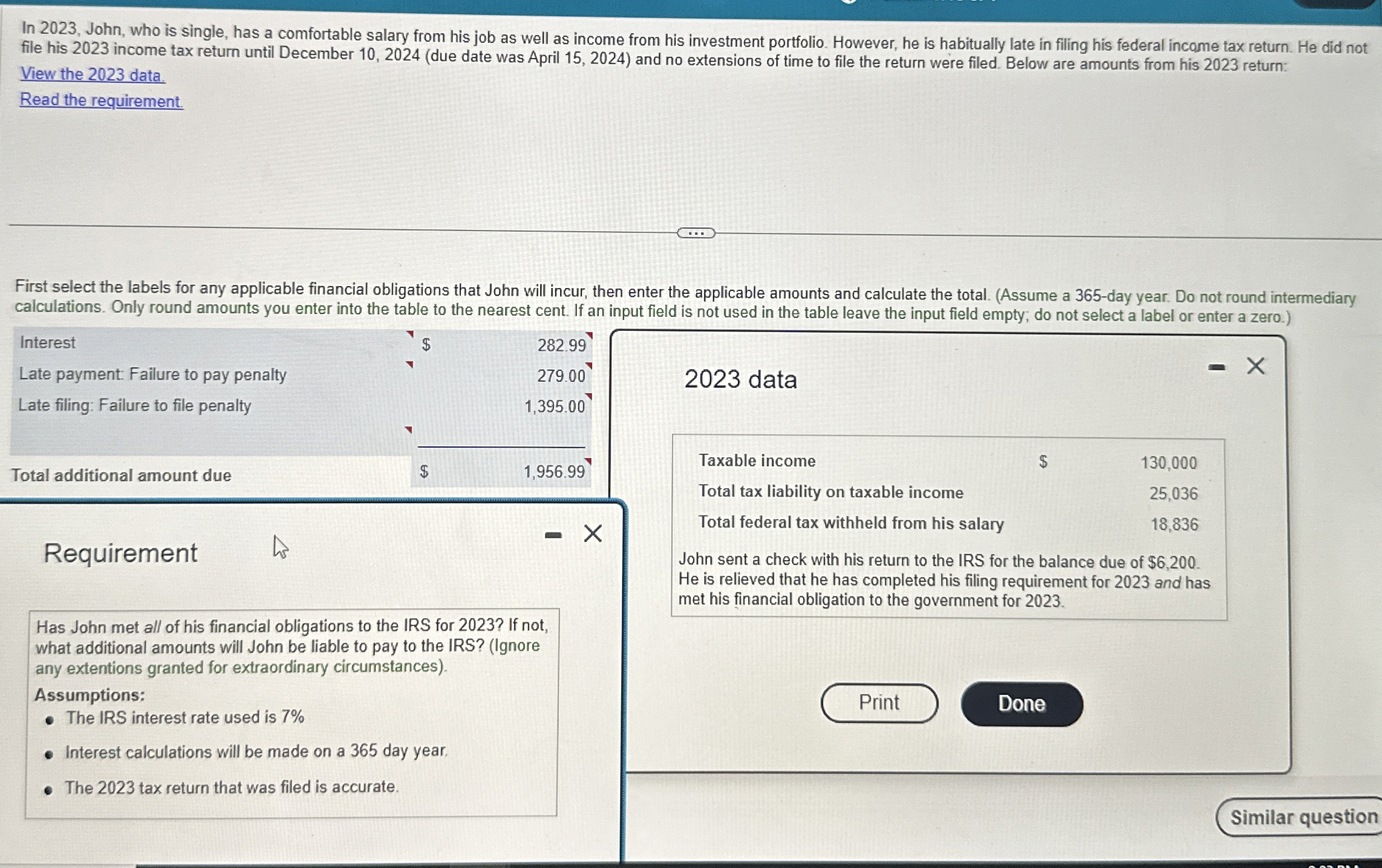

Question: nIn 2 0 2 3 , John, who is single, has a comfortable salary from his job as well as income from his investment portfolio.

nIn John, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did not file his income tax return until December due date was April and no extensions of time to file the return were filed. Below are amounts from his return:

View the data.

Read the requirement.

First select the labels for any applicable financial obligations that John will incur, then enter the applicable amounts and calculate the total. Assume a day year. Do not round intermediary calculations. Only round amounts you enter into the table to the nearest cent. If an input field is not used in the table leave the input field empty; do not select a label or enter a zero.

tableInterest$Late payment: Failure to pay penalty,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock