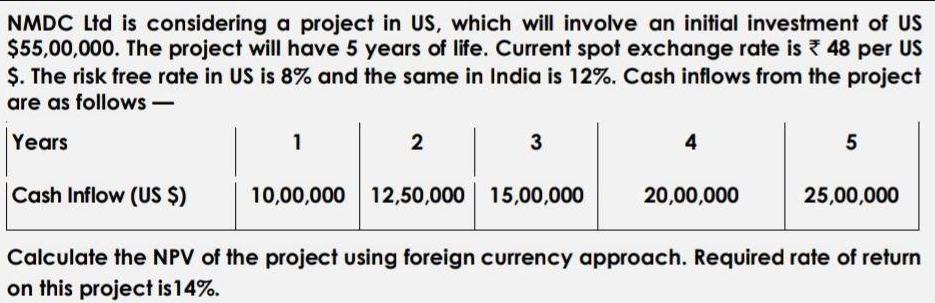

Question: NMDC Ltd is considering a project in US, which will involve an initial investment of US $55,00,000. The project will have 5 years of

NMDC Ltd is considering a project in US, which will involve an initial investment of US $55,00,000. The project will have 5 years of life. Current spot exchange rate is 48 per US $. The risk free rate in US is 8% and the same in India is 12%. Cash inflows from the project are as follows - Years 1 2 3 4 5 Cash Inflow (US $) 10,00,000 12,50,000 15,00,000 20,00,000 25,00,000 Calculate the NPV of the project using foreign currency approach. Required rate of return on this project is 14%.

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Foreigncurrency approach Foreigncurrency cash flows are d... View full answer

Get step-by-step solutions from verified subject matter experts