Question: nment 4-2 Week 4 Practice 1 Fill in the missing amounts in each of the eight case situations below. Each case is independent of the

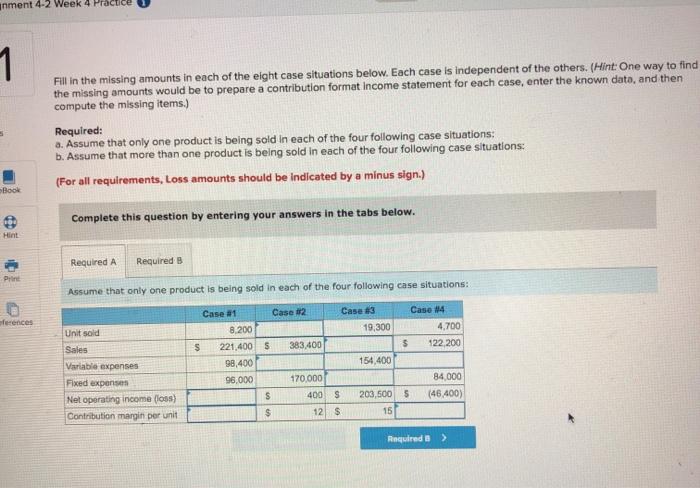

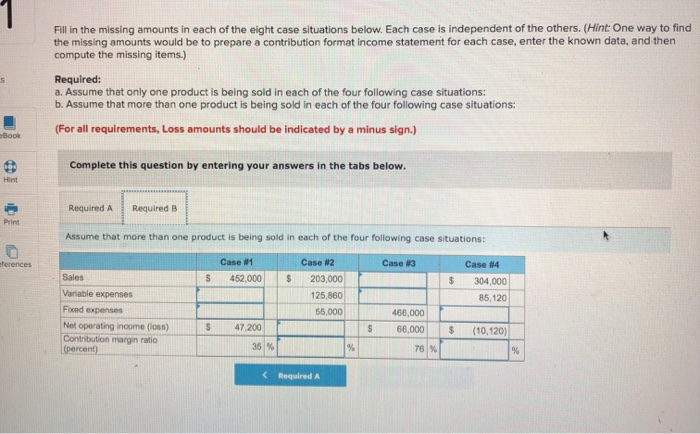

nment 4-2 Week 4 Practice 1 Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.) Required: a. Assume that only one product is being sold in each of the four following case situations: b. Assume that more than one product is being sold in each of the four following case situations: (For all requirements, Loss amounts should be indicated by a minus sign.) Book Complete this question by entering your answers in the tabs below. Hint Required A Required B print Assume that only one product is being sold in each of the four following case situations: ferences Unit sold S Sales Variable expenses Fixed expenses Net operating income (loss) Contribution margin per unit Case 1 Case #2 Case 3 Case #4 8.200 19,300 4,700 221,400 $ 383,400 $ 122,200 98,400 154,400 96.000 170,000 84.000 S 400 S 203,500 $ (46.400) $ 12 $ 15 Required B > 5 Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.) Required: a. Assume that only one product is being sold in each of the four following case situations: b. Assume that more than one product is being sold in each of the four following case situations: (For all requirements, Loss amounts should be indicated by a minus sign.) Book Complete this question by entering your answers in the tabs below. Required A Required B Print Assume that more than one product is being sold in each of the four following case situations: ferences Case #3 Case 1 452,000 S $ $ Case #2 203,000 125,860 55,000 Case #14 304,000 85,120 Sales Variable expenses Forced expenses Net operating income (5) Contribution margin ratio (percent) 466,000 66,000 s $ $ 47.200 35 % (10,120) % 76% %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts