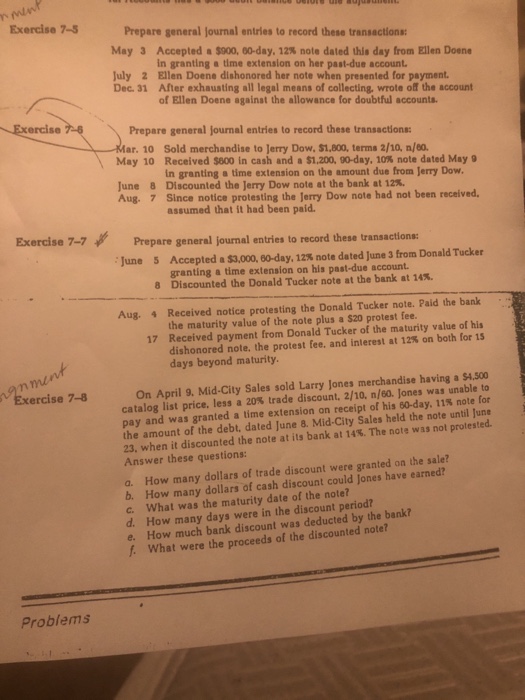

Question: nmint Exercise 7-5 Prepare general journal entries to record these transactions May 3 Accepted a $100, 00-day, 12% note dated this day from Ellen Doene

nmint Exercise 7-5 Prepare general journal entries to record these transactions May 3 Accepted a $100, 00-day, 12% note dated this day from Ellen Doene in granting a time extension on her past-due account July 2 Ellen Doene dishonored her note when presented for payment. Dec. 31 After exhausting all legal means of collecting, wrote of the account of Ellen Doene againat the allowance for doubtful accounts ercise Prepare general journal entries to record these transactions: ?-Mar. 10 Sold merchandise to Jerry Dow, $1,000, terms 2/10, n/m May 10 Received $800 in cash and a s1.200. 90-day, 10% note dated May 9 June Aug. 7 Since notice protesting the Jerry Dow note had not been received. in granting a time extension on the amount due from Jerry Dow. Discounted the Jerry Dow note at the bank at 12%. 8 assumed that it had been paid. Prepare general journal entries to record these transactions : June 5 Accepted a $3,000, 60-day, 12% note dated June 3 from Donald Tucker granting a time extension on his past-due account Discounted the Donald Tucker note at the bank at 14%. 8 Aug. Received notice protesting the Donald Tucker note. Paid the bank the maturity value of the note plus a $20 protest fee. Received payment from Donald Tucker of the maturity value of his dishonored note, the protest fee, and interest at 12% on both for 1s days beyond maturity. 17 inment Exercise 7-8 On April 9. Mid-City Sales sold Larry Jones merchandise having a $4,500 catalog list price, less a 20% trade discount, 2/10, n/ea. lones was unable to pay and was granted a time extension on receipt of his 60 day. 11% note for the amount of the debt, dated June 8. Mid-City Sales held the note until June 23, when it discounted the note at its bank at 14%. The note was not protested. Answer these questions: a. How many dollars of trade discount were granted on the sale? b. How many dollars of cash discount could Jones have earned? c. What was the maturity date of the note? d. How many days were in the discount period? e. How much bank discount was deducted by the bank? What were the proceeds of the discounted note? Problems nmint Exercise 7-5 Prepare general journal entries to record these transactions May 3 Accepted a $100, 00-day, 12% note dated this day from Ellen Doene in granting a time extension on her past-due account July 2 Ellen Doene dishonored her note when presented for payment. Dec. 31 After exhausting all legal means of collecting, wrote of the account of Ellen Doene againat the allowance for doubtful accounts ercise Prepare general journal entries to record these transactions: ?-Mar. 10 Sold merchandise to Jerry Dow, $1,000, terms 2/10, n/m May 10 Received $800 in cash and a s1.200. 90-day, 10% note dated May 9 June Aug. 7 Since notice protesting the Jerry Dow note had not been received. in granting a time extension on the amount due from Jerry Dow. Discounted the Jerry Dow note at the bank at 12%. 8 assumed that it had been paid. Prepare general journal entries to record these transactions : June 5 Accepted a $3,000, 60-day, 12% note dated June 3 from Donald Tucker granting a time extension on his past-due account Discounted the Donald Tucker note at the bank at 14%. 8 Aug. Received notice protesting the Donald Tucker note. Paid the bank the maturity value of the note plus a $20 protest fee. Received payment from Donald Tucker of the maturity value of his dishonored note, the protest fee, and interest at 12% on both for 1s days beyond maturity. 17 inment Exercise 7-8 On April 9. Mid-City Sales sold Larry Jones merchandise having a $4,500 catalog list price, less a 20% trade discount, 2/10, n/ea. lones was unable to pay and was granted a time extension on receipt of his 60 day. 11% note for the amount of the debt, dated June 8. Mid-City Sales held the note until June 23, when it discounted the note at its bank at 14%. The note was not protested. Answer these questions: a. How many dollars of trade discount were granted on the sale? b. How many dollars of cash discount could Jones have earned? c. What was the maturity date of the note? d. How many days were in the discount period? e. How much bank discount was deducted by the bank? What were the proceeds of the discounted note? Problems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts