Question: No 3, 4, 5, 7 COMPREHENSIVE CASE - 100% At the end of the Hope Store's fiscal year on November 30, 2019, the following accounts

No 3, 4, 5, 7

No 3, 4, 5, 7

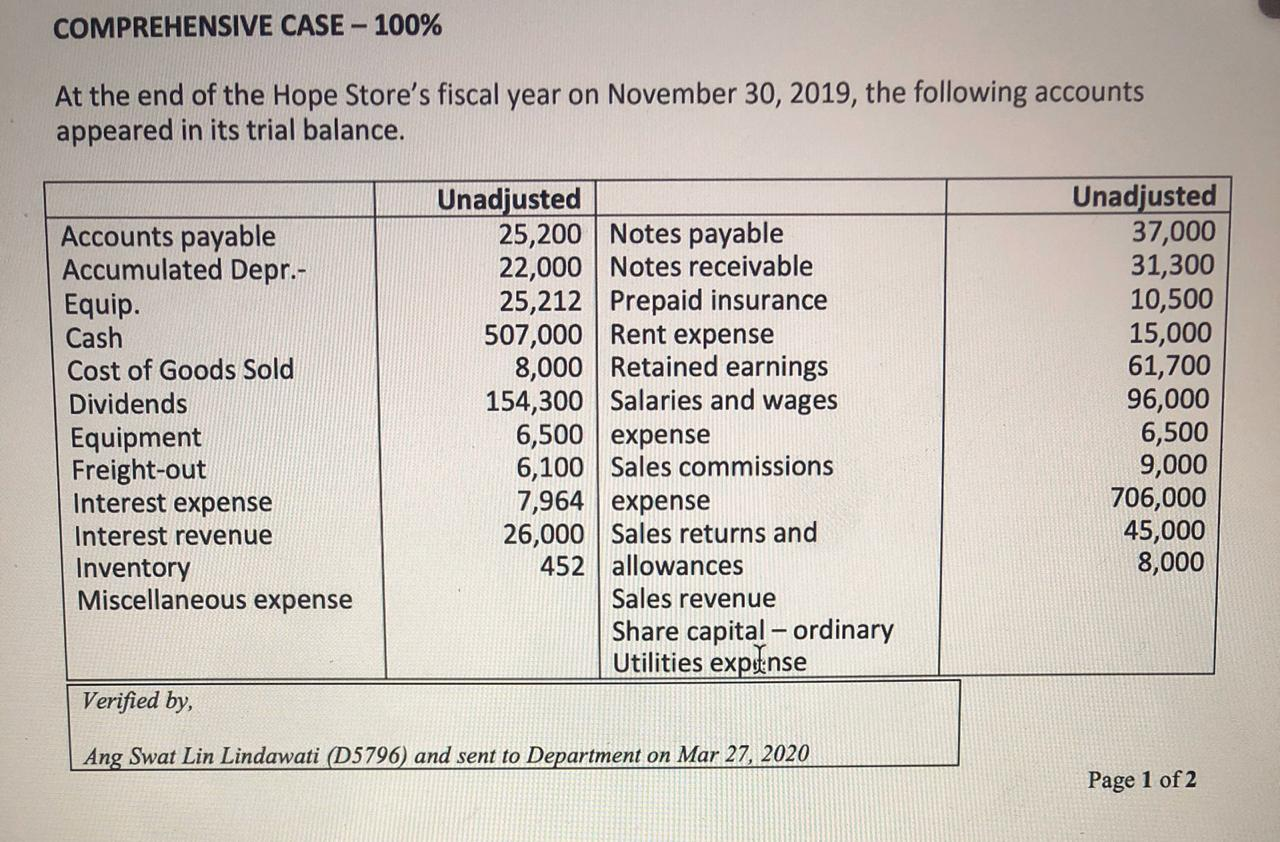

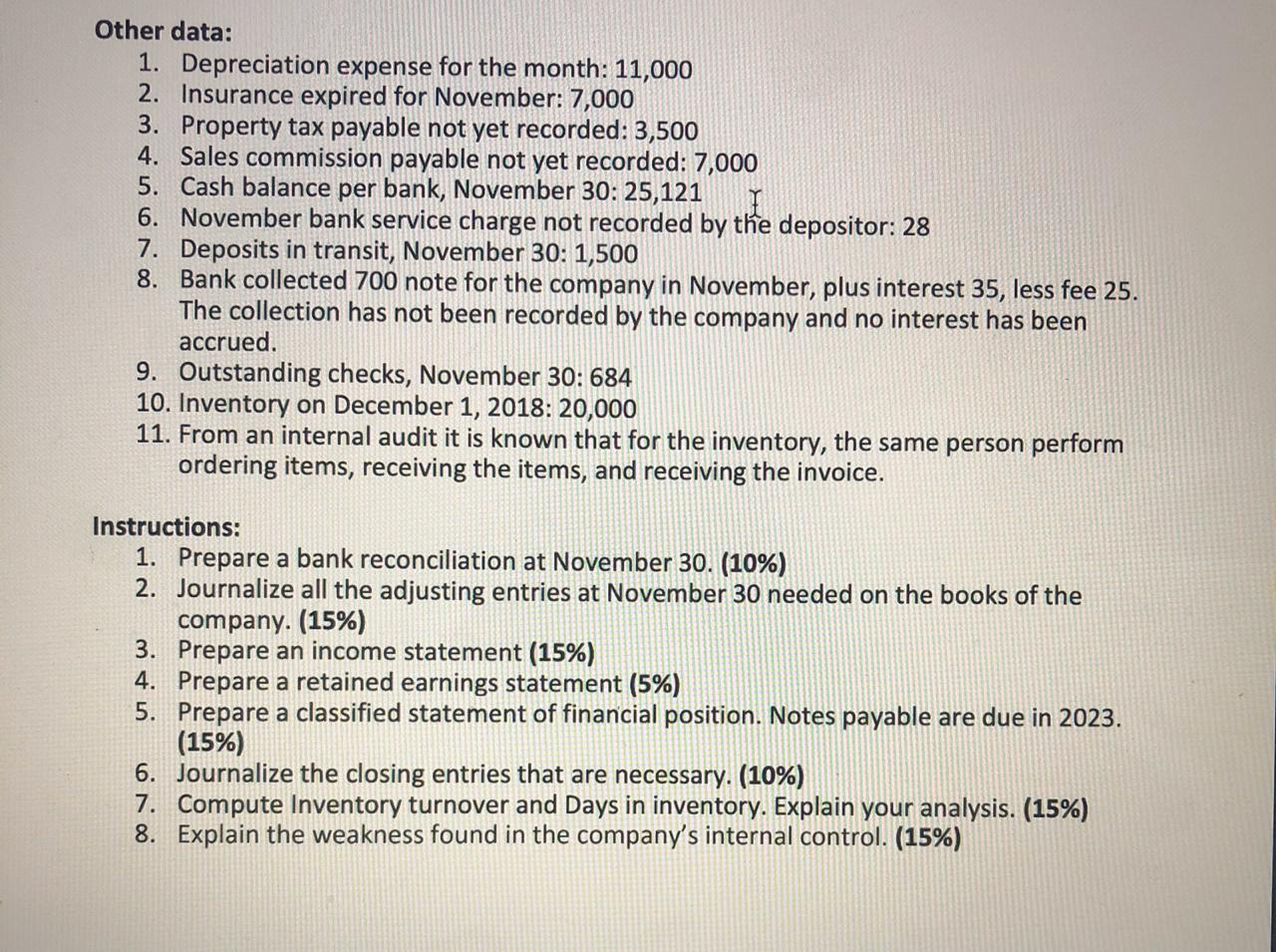

COMPREHENSIVE CASE - 100% At the end of the Hope Store's fiscal year on November 30, 2019, the following accounts appeared in its trial balance. Accounts payable Accumulated Depr.- Equip. Cash Cost of Goods Sold Dividends Equipment Freight-out Interest expense Interest revenue Inventory Miscellaneous expense Unadjusted 25,200 Notes payable 22,000 Notes receivable 25,212 Prepaid insurance 507,000 Rent expense 8,000 Retained earnings 154,300 Salaries and wages expense 6,100 Sales commissions 7,964 expense 26,000 Sales returns and 452 allowances Sales revenue Share capital - ordinary Utilities expense Unadjusted 37,000 31,300 10,500 15,000 61,700 96,000 6,500 9,000 706,000 45,000 8,000 | Verified by, Ang Swat Lin Lindawati (D5796) and sent to Department on Mar 27, 2020 Page 1 of 2 Other data: 1. Depreciation expense for the month: 11,000 2. Insurance expired for November: 7,000 3. Property tax payable not yet recorded: 3,500 4. Sales commission payable not yet recorded: 7,000 5. Cash balance per bank, November 30: 25,121 6. November bank service charge not recorded by the depositor: 28 7. Deposits in transit, November 30: 1,500 8. Bank collected 700 note for the company in November, plus interest 35, less fee 25. The collection has not been recorded by the company and no interest has been accrued. 9. Outstanding checks, November 30: 684 10. Inventory on December 1, 2018: 20,000 11. From an internal audit it is known that for the inventory, the same person perform ordering items, receiving the items, and receiving the invoice. Instructions: 1. Prepare a bank reconciliation at November 30. (10%) 2. Journalize all the adjusting entries at November 30 needed on the books of the company. (15%) 3. Prepare an income statement (15%) 4. Prepare a retained earnings statement (5%) 5. Prepare a classified statement of financial position. Notes payable are due in 2023. (15%) 6. Journalize the closing entries that are necessary. (10%) 7. Compute Inventory turnover and Days in inventory. Explain your analysis. (15%) 8. Explain the weakness found in the company's internal control. (15%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts