Question: No additional details needed. Problem 17. An enterprise had the following data: Taxable Year Gross Income Taxable income Months covered by NIRC Months covered by

No additional details needed.

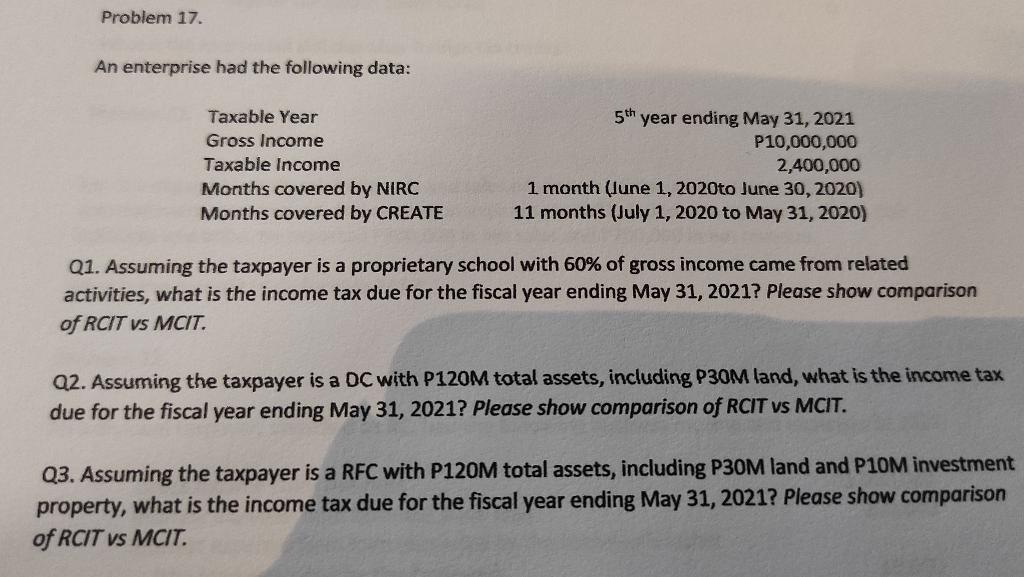

Problem 17. An enterprise had the following data: Taxable Year Gross Income Taxable income Months covered by NIRC Months covered by CREATE 5th year ending May 31, 2021 P10,000,000 2,400,000 1 month (lune 1, 2020to June 30, 2020) 11 months (July 1, 2020 to May 31, 2020) Q1. Assuming the taxpayer is a proprietary school with 60% of gross income came from related activities, what is the income tax due for the fiscal year ending May 31, 2021? Please show comparison of RCIT VS MCIT. 22. Assuming the taxpayer is a DC with P120M total assets, including P30M land, what is the income tax due for the fiscal year ending May 31, 2021? Please show comparison of RCIT VS MCIT. Q3. Assuming the taxpayer is a RFC with P120M total assets, including P30M land and P10M investment property, what is the income tax due for the fiscal year ending May 31, 2021? Please show comparison of RCIT vs MCIT. Problem 17. An enterprise had the following data: Taxable Year Gross Income Taxable income Months covered by NIRC Months covered by CREATE 5th year ending May 31, 2021 P10,000,000 2,400,000 1 month (lune 1, 2020to June 30, 2020) 11 months (July 1, 2020 to May 31, 2020) Q1. Assuming the taxpayer is a proprietary school with 60% of gross income came from related activities, what is the income tax due for the fiscal year ending May 31, 2021? Please show comparison of RCIT VS MCIT. 22. Assuming the taxpayer is a DC with P120M total assets, including P30M land, what is the income tax due for the fiscal year ending May 31, 2021? Please show comparison of RCIT VS MCIT. Q3. Assuming the taxpayer is a RFC with P120M total assets, including P30M land and P10M investment property, what is the income tax due for the fiscal year ending May 31, 2021? Please show comparison of RCIT vs MCIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts