Question: -------NO ANSWER NEEDED FROM ORIGINAL QUESTION-------- I need to know what some of the solution means. How did the row to supplier get there? 68.40

-------NO ANSWER NEEDED FROM ORIGINAL QUESTION--------

I need to know what some of the solution means.

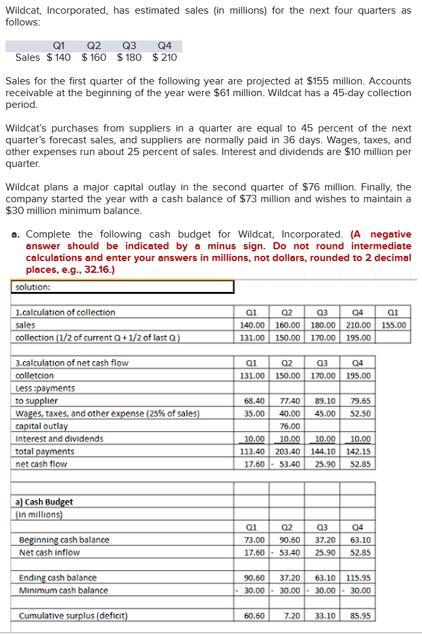

How did the row "to supplier" get there? 68.40 , 77.40, 89.10, 79.65 please work where they came from as I don't understand where the numbers came from.

Wildcat, Incorporated, has estimated sales (in Millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $ 140 $160 S 180 $ 210 Sales for the first quarter of the following year are projected at $155 million. Accounts receivable at the beginning of the year were $61 milion. Wildcat has a 45-day collection period. Wildcat's purchases from suppliers in a quarter are equal to 45 percent of the next quarter's forecast sales, and suppliers are normally paid in 36 days Wages, taxes, and other expenses run about 25 percent of sales. Interest and dividends are $10 million per quarter. Wildcat plans a major capital outlay in the second quarter of $76 million. Finally, the company started the year with a cash balance of $73 million and wishes to maintain a $30 million minimum balance. a. Complete the following cash budget for Wildcat, Incorporated. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions, not dollars, rounded to 2 decimal places, e.g.. 32.16.) solution: 1.calculation of collection sales collection (1/2 of current Q +1/2 of last Q) Q a1 140.00 131.00 Q2 Q3 94 1 160.00 180.00 210.00 155.00 150.00 170.00 195.00 Q1 131.00 Q2 03 150.00 170.00 04 195.00 3.calculation of net cash flow colletion less payments to supplier Wages, taxes, and other expense (25% of sales) capital outlay Interest and dividends total payments net cash flow 89.10 45.00 79.65 52.50 68.40 77.40 35.00 40.00 76.00 10.00 10.00 113.40 203.40 17.60 53.40 10.00 144.10 25.90 10.00 142.15 52.85 a) Cash Budget fin millions) Q3 Q1 73.00 17.60 Beginning cash balance Ner cash inflow Q2 90.60 53.40 37.20 04 63.10 52.85 25.90 Ending cash balance Minimum cash balance 90.60 30.00 37.20 30.00 63.10 30.00 115.95 30.00 Cumulative surplus deficit) 60.60 7.20 33.10 85.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts