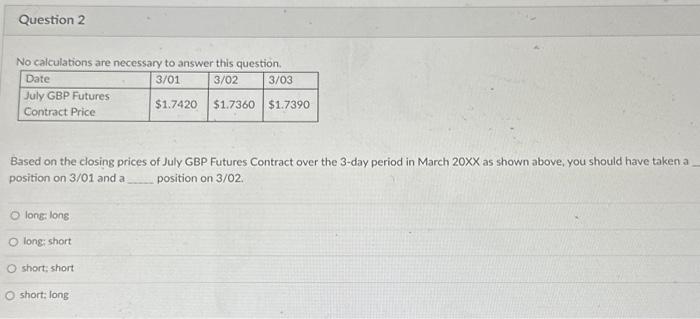

Question: No calculations are necessary to answer this question. Based on the closing prices of July GBP Futures Contract over the 3-day period in March 20XX

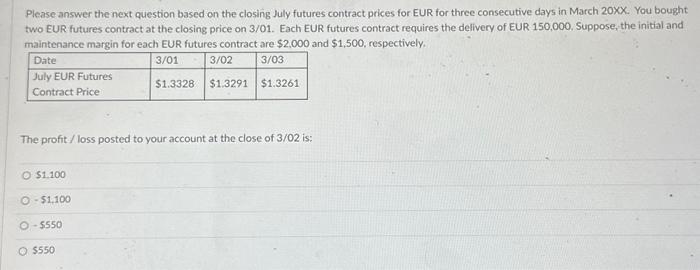

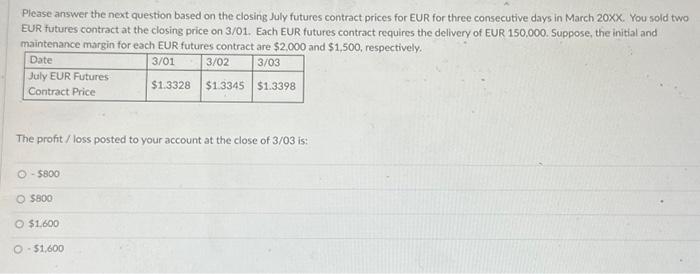

No calculations are necessary to answer this question. Based on the closing prices of July GBP Futures Contract over the 3-day period in March 20XX as shown above, you should have taken a position on 3/01 and a position on 3/02. longi lons long; short short:short short: long Please answer the next question based on the closing July futures contract prices for EUR for three consecutive days in March 20XX. You bought two EUR futures contract at the closing price on 3/01. Each EUR futures contract requires the delivery of EUR 150,000 , Suppose, the initial and maintenance marsin for each EUR futures contract are $2,000 and $1,500, respectively. The profit/ loss posted to your account at the close of 3/02 is: $1.100 51,100 5550 $550 Please answer the next question based on the closing July futures contract prices for EUR for three consecutive days in March 20xX. You sold two EUR futures contract at the closing price on 3/01. Each EUR futures contract requires the delivery of EUR 150,000 . Suppose, the initial and maintenance margin for each EUR futures contract are $2.000 and $1,500, respectively. The profit / loss posted to your account at the close of 3/03 is: 5800 5800 $1.600 51.600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts