Question: no cursive please (regular writing only) Hammond Inc. had the following balance sheet at the end of 2019: Freeman INC. Statement of Financial Position December

no cursive please (regular writing only)

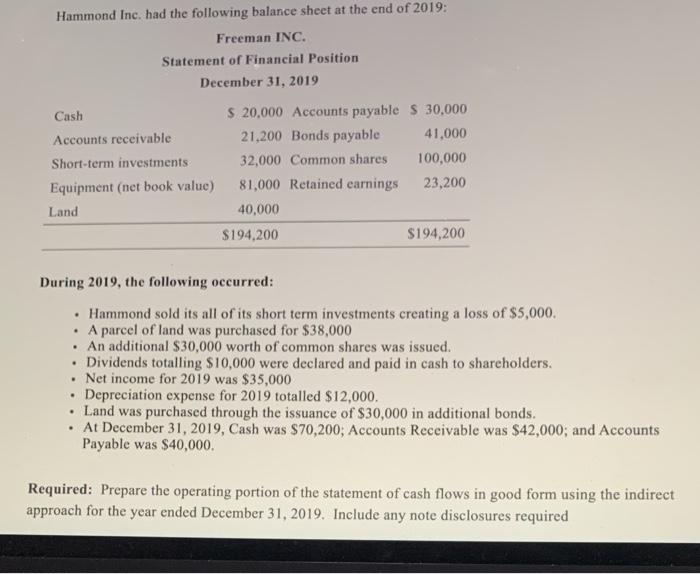

no cursive please (regular writing only)Hammond Inc. had the following balance sheet at the end of 2019: Freeman INC. Statement of Financial Position December 31, 2019 Cash Accounts receivable Short-term investments Equipment (net book value) Land $ 20,000 Accounts payable S 30,000 21,200 Bonds payable 41,000 32,000 Common shares 100,000 81,000 Retained earnings 23,200 40,000 $194,200 $194,200 During 2019, the following occurred: Hammond sold its all of its short term investments creating a loss of $5,000. A parcel of land was purchased for $38,000 . An additional $30,000 worth of common shares was issued. Dividends totalling $10,000 were declared and paid in cash to shareholders. Net income for 2019 was $35,000 Depreciation expense for 2019 totalled $12,000. Land was purchased through the issuance of $30,000 in additional bonds. At December 31, 2019, Cash was $70,200; Accounts Receivable was $42,000; and Accounts Payable was $40,000 . . . Required: Prepare the operating portion of the statement of cash flows in good form using the indirect approach for the year ended December 31, 2019. Include any note disclosures required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts