Question: no excel 4. When Interest rate changes, the impact on a bank's earnings depends on the repricing of their assets or liabilities. = $250 Loan

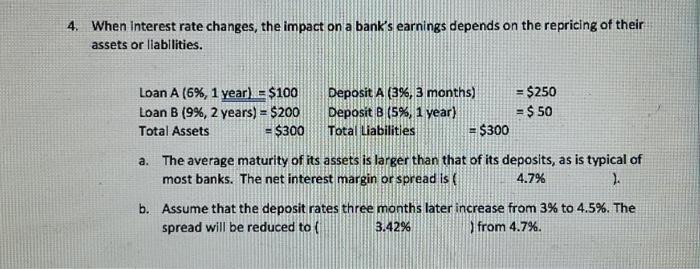

4. When Interest rate changes, the impact on a bank's earnings depends on the repricing of their assets or liabilities. = $250 Loan A (6%, 1 year) = $100 Loan B (9%, 2 years) = $200 Total Assets Deposit A (3%, 3 months) Deposit B (5%, 1 year) Total Liabilities = $50 = $300 =$300 a. The average maturity of its assets is larger than that of its deposits, as is typical of most banks. The net interest margin or spread is ( 4.7% ). b. Assume that the deposit rates three months later increase from 3% to 4.5%. The spread will be reduced to ( 3.42% from 4.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts