Question: no excel or table please You are given the task of calculating the cost of capital of Kingston Toys. The company faces a tax rate

no excel or table please

no excel or table please

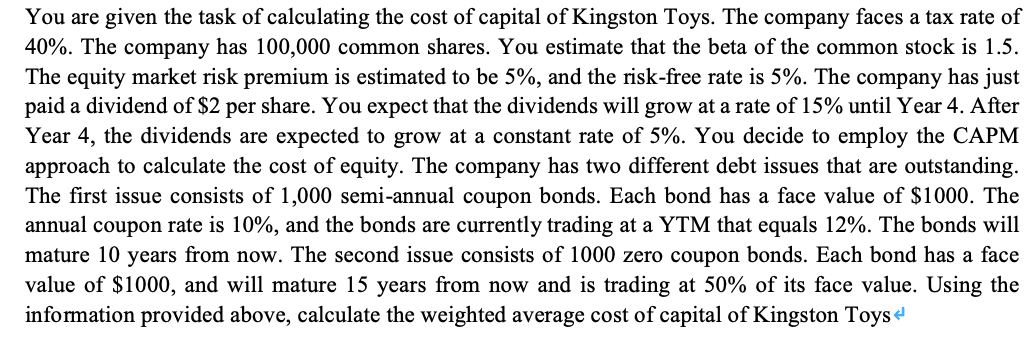

You are given the task of calculating the cost of capital of Kingston Toys. The company faces a tax rate of 40%. The company has 100,000 common shares. You estimate that the beta of the common stock is 1.5. The equity market risk premium is estimated to be 5%, and the risk-free rate is 5%. The company has just paid a dividend of $2 per share. You expect that the dividends will grow at a rate of 15% until Year 4. After Year 4, the dividends are expected to grow at a constant rate of 5%. You decide to employ the CAPM approach to calculate the cost of equity. The company has two different debt issues that are outstanding. The first issue consists of 1,000 semi-annual coupon bonds. Each bond has a face value of $1000. The annual coupon rate is 10%, and the bonds are currently trading at a YTM that equals 12%. The bonds will mature 10 years from now. The second issue consists of 1000 zero coupon bonds. Each bond has a face value of $1000, and will mature 15 years from now and is trading at 50% of its face value. Using the information provided above, calculate the weighted average cost of capital of Kingston Toys

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts