Question: NO EXCEL SOLUTIONS; NEED HANDWRITTEN CALCULATIONS HANDWRITTEN CALCULATIONS ONLY Question 2 Olive Bread manufactures a special type of bread customized to orders. The company has

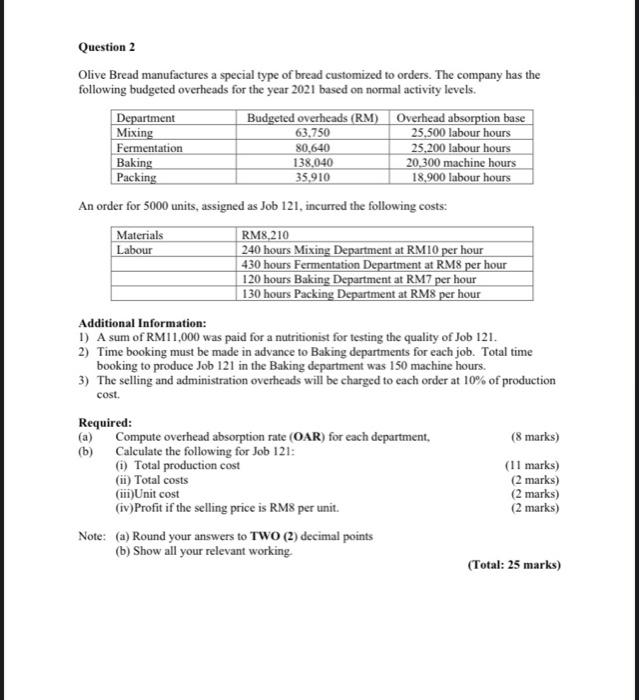

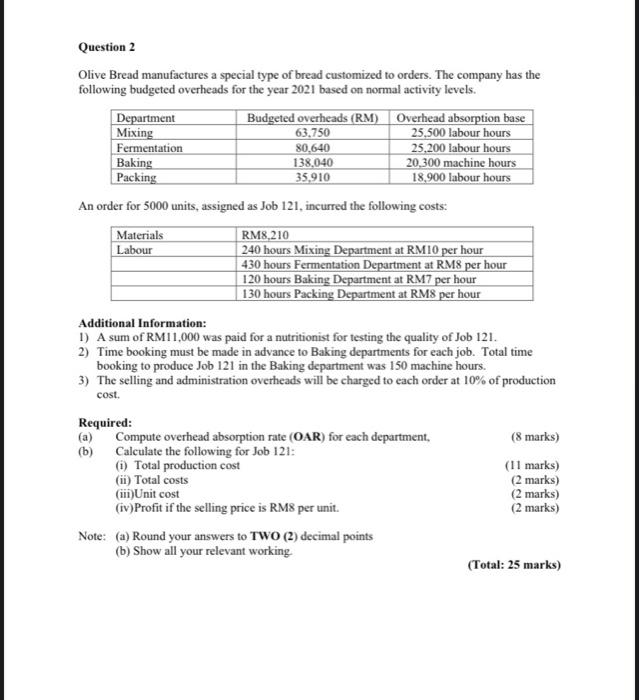

Question 2 Olive Bread manufactures a special type of bread customized to orders. The company has the following budgeted overheads for the year 2021 based on normal activity levels. Department Budgeted overheads (RM) Overhead absorption base Mixing 63.750 25,500 labour hours Fermentation 80.640 25,200 labour hours Baking 138,040 20.300 machine hours Packing 35.910 18.900 labour hours An order for 5000 units, assigned as Job 121, incurred the following costs: Materials RM8,210 Labour 240 hours Mixing Department at RMIO per hour 430 hours Fermentation Department at RM8 per hour 120 hours Baking Department at RM7 per hour 130 hours Packing Department at RM8 per hour Additional Information: 1) A sum of RM11,000 was paid for a nutritionist for testing the quality of Job 121. 2) Time booking must be made in advance to Baking departments for each job. Total time booking to produce Job 121 in the Baking department was 150 machine hours. 3) The selling and administration overheads will be charged to each order at 10% of production cost. Required: (a) Compute overhead absorption rate (OAR) for each department, (b) Calculate the following for Job 121: (i) Total production cost (ii) Total costs (i)Unit cost (iv)Profit if the selling price is RM8 per unit. Note: (a) Round your answers to TWO (2) decimal points (b) Show all your relevant working (8 marks) (11 marks) (2 marks) (2 marks) (2 marks) (Total: 25 marks) Question 2 Olive Bread manufactures a special type of bread customized to orders. The company has the following budgeted overheads for the year 2021 based on normal activity levels. Department Budgeted overheads (RM) Overhead absorption base Mixing 63.750 25,500 labour hours Fermentation 80.640 25,200 labour hours Baking 138,040 20.300 machine hours Packing 35.910 18.900 labour hours An order for 5000 units, assigned as Job 121, incurred the following costs: Materials RM8,210 Labour 240 hours Mixing Department at RMIO per hour 430 hours Fermentation Department at RM8 per hour 120 hours Baking Department at RM7 per hour 130 hours Packing Department at RM8 per hour Additional Information: 1) A sum of RM11,000 was paid for a nutritionist for testing the quality of Job 121. 2) Time booking must be made in advance to Baking departments for each job. Total time booking to produce Job 121 in the Baking department was 150 machine hours. 3) The selling and administration overheads will be charged to each order at 10% of production cost. Required: (a) Compute overhead absorption rate (OAR) for each department, (b) Calculate the following for Job 121: (i) Total production cost (ii) Total costs (i)Unit cost (iv)Profit if the selling price is RM8 per unit. Note: (a) Round your answers to TWO (2) decimal points (b) Show all your relevant working (8 marks) (11 marks) (2 marks) (2 marks) (2 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts