Question: No excel, Thank you. and show formulas 19. You are a financial analyst for the Hittle Company. The director of capital budgeting has asked you

No excel, Thank you. and show formulas

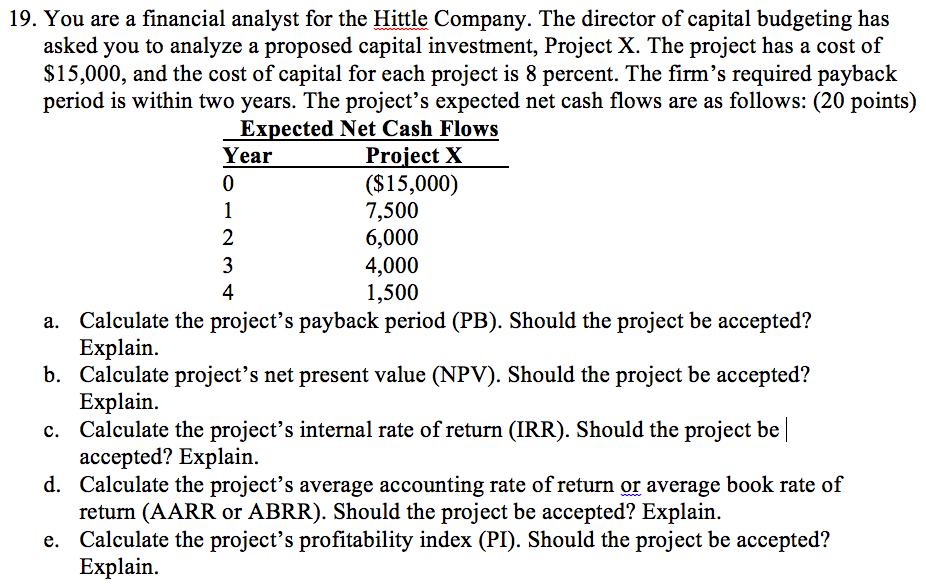

19. You are a financial analyst for the Hittle Company. The director of capital budgeting has asked you to analyze a proposed capital investment, Project X. The project has a cost of $15,000, and the cost of capital for each project is 8 percent. The firm's required payback period is within two years. The project's expected net cash flows are as follows: (20 points) Expected Net Cash Flows Year Project X 0 ($15,000) 1 7,500 2 6,000 3 4,000 4 1,500 a. Calculate the projects payback period (PB). Should the project be accepted? Explain. b. Calculate project's net present value (NPV). Should the project be accepted? Explain. c. Calculate the project's internal rate of return (IRR). Should the project be| accepted? Explain. d. Calculate the project's average accounting rate of return or average book rate of return (AARR or ABRR). Should the project be accepted? Explain. e. Calculate the project's profitability index (PI). Should the project be accepted? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts