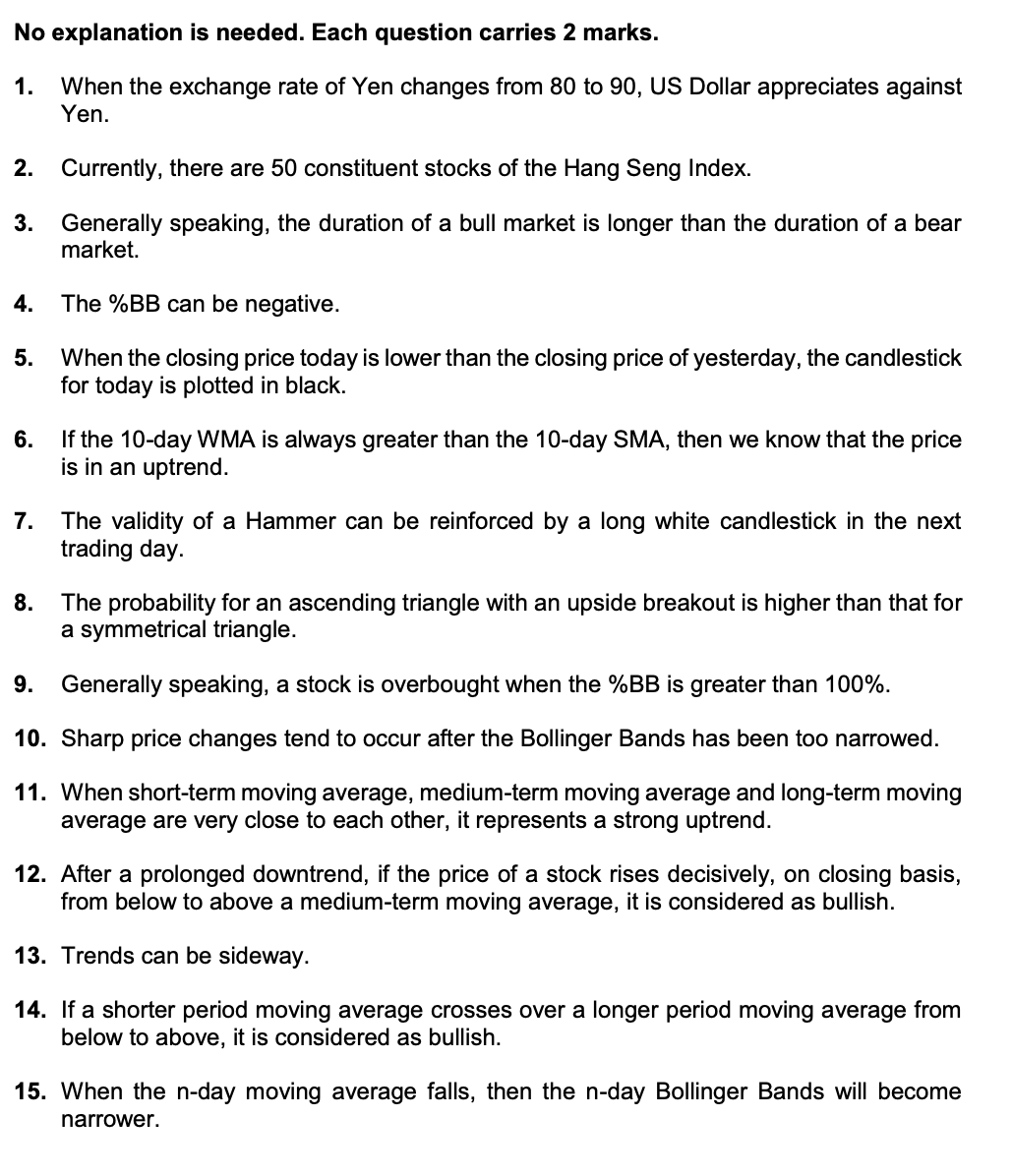

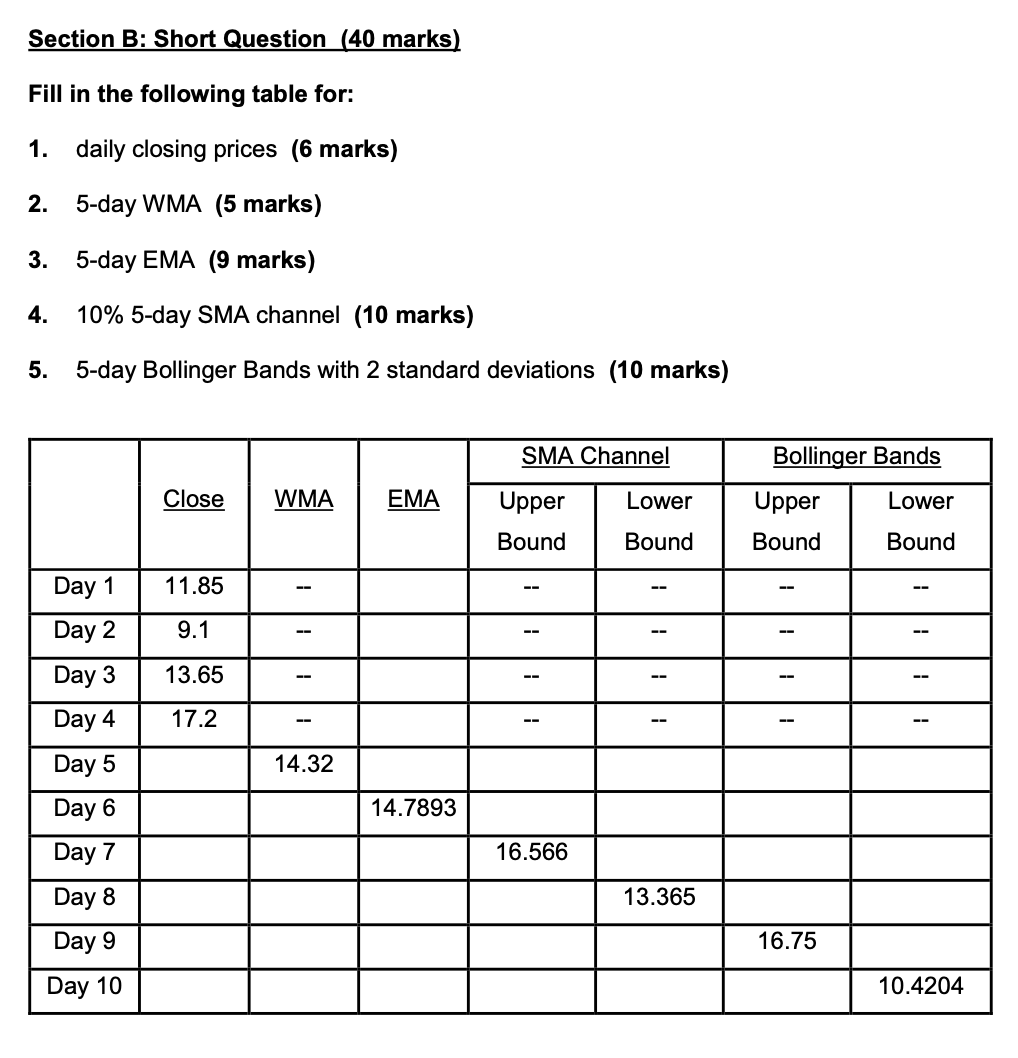

Question: No explanation is needed. Each question carries 2 marks. 1. 10. 11. 12. 13. 14. 15. When the exchange rate of Yen changes from 80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts