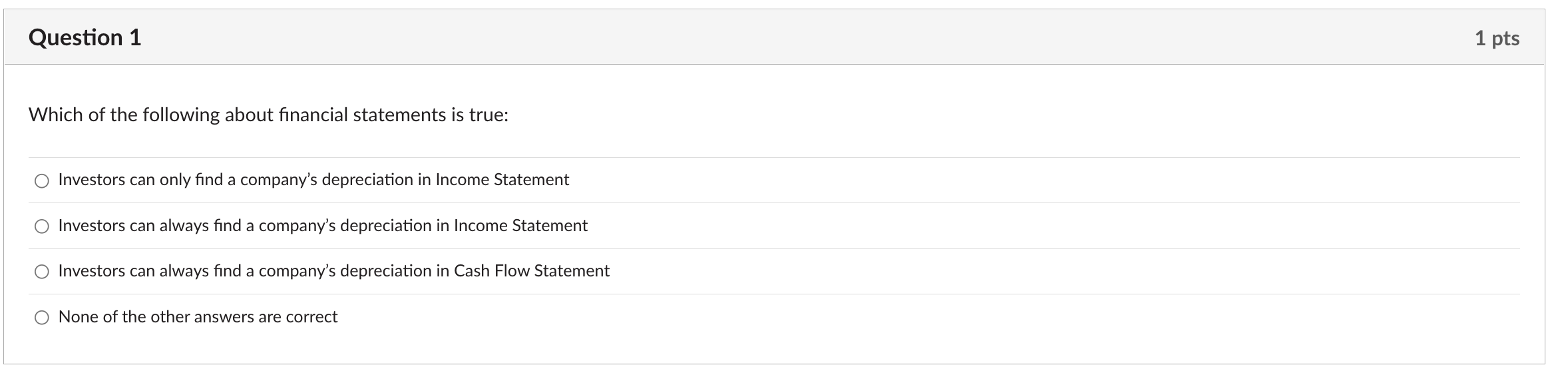

Question: No explanation needed, need to double check Question 1 1 pts Which of the following about financial statements is true: Investors can only find a

No explanation needed, need to double check

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock