Question: no explanation needed, please answer all the MCQs only Styles Editing Adob 69. A customer deposited 10,000 in her bank. From this the bank made

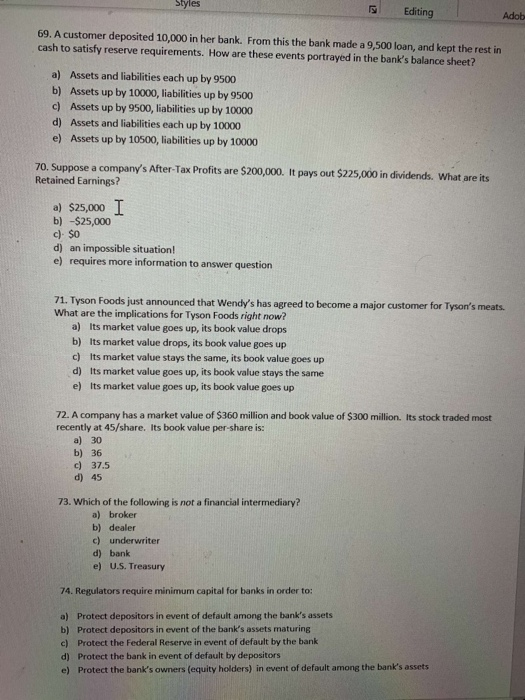

Styles Editing Adob 69. A customer deposited 10,000 in her bank. From this the bank made a 9,500 loan, and kept the rest in cash to satisfy reserve requirements. How are these events portrayed in the bank's balance sheet? a) Assets and liabilities each up by 9500 b) Assets up by 10000, liabilities up by 9500 c) Assets up by 9500, liabilities up by 10000 d) Assets and liabilities each up by 10000 e) Assets up by 10500, liabilities up by 10000 70. Suppose a company's After Tax Profits are $200,000. It pays out $225,000 in dividends. What are its Retained Earnings? a) $25,000 I b) -$25,000 c). $0 d) an impossible situation! e) requires more information to answer question 71. Tyson Foods just announced that Wendy's has agreed to become a major customer for Tyson's meats. What are the implications for Tyson Foods right now? a) Its market value goes up, its book value drops b) Its market value drops, its book value goes up c) Its market value stays the same, its book value goes up d) Its market value goes up, its book value stays the same e) Its market value goes up, its book value goes up 72. A company has a market value of $360 million and book value of $300 million. Its stock traded most recently at 45/share. Its book value per-share is: a) 30 b) 36 c) 37.5 d) 45 73. Which of the following is not a financial intermediary? a) broker b) dealer c) underwriter d) bank e) U.S. Treasury 74. Regulators require minimum capital for banks in order to: a) Protect depositors in event of default among the bank's assets b) Protect depositors in event of the bank's assets maturing c) Protect the Federal Reserve in event of default by the bank d) Protect the bank in event of default by depositors e) Protect the bank's owners (equity holders) in event of default among the bank's assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts