Question: no explanation needed Which of the following will decrease the quick ratio? a. sale of inventory for cash b. sale of inventory on credit c.

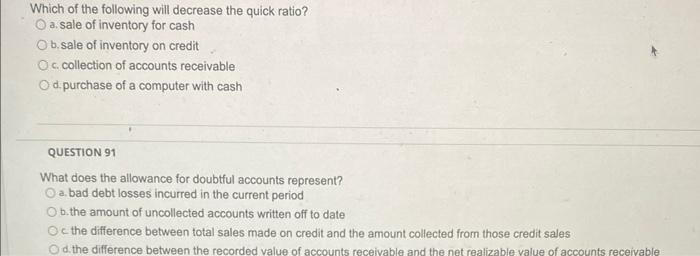

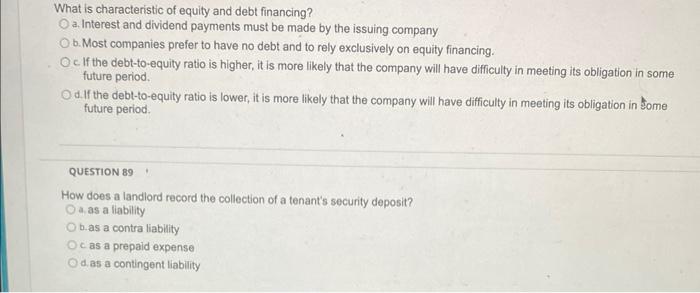

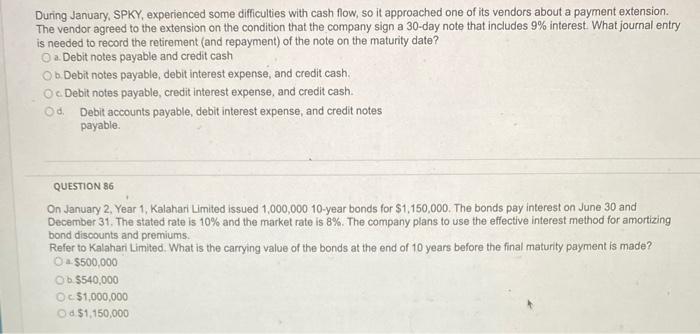

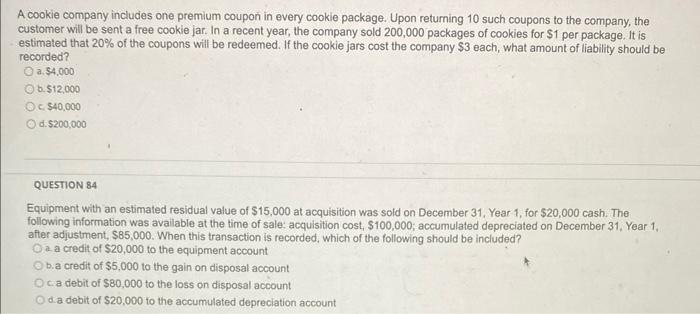

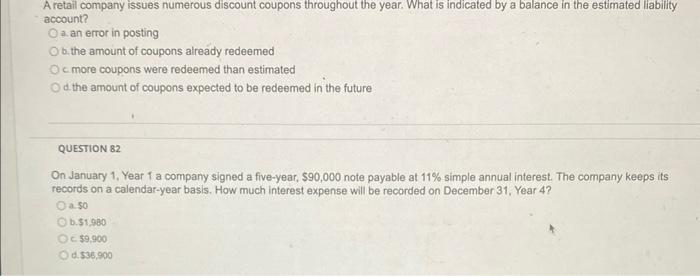

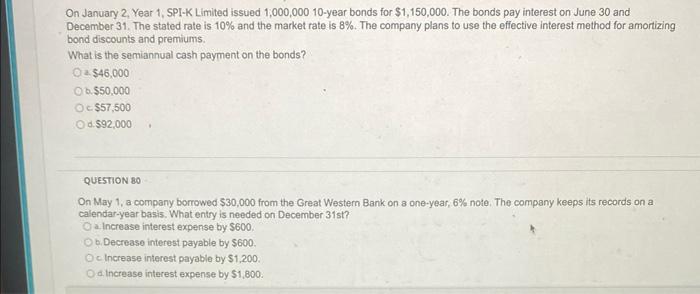

Which of the following will decrease the quick ratio? a. sale of inventory for cash b. sale of inventory on credit c. collection of accounts receivable d. purchase of a computer with cash QUESTION 91 What does the allowance for doubtful accounts represent? a. bad debt losses incurred in the current period b. the amount of uncollected accounts written off to date c the difference between total sales made on credit and the amount collected from those credit sales d. the difference between the recorded value of accounts receivable and the net realizable value of accounts receivable What is characteristic of equity and debt financing? a. Interest and dividend payments must be made by the issuing company b. Most companies prefer to have no debt and to rely exclusively on equity financing. c. If the debt-to-equity ratio is higher, it is more likely that the company will have difficulty in meeting its obligation in some future period. d.If the debt-to-equity ratio is lower, it is more likely that the company will have difficulty in meeting its obligation in some future period. QUESTION 89 How does a landlord record the collection of a tenant's security deposit? a. as a fiability b.as a contra liability c. as a prepaid expense d. as a contingent liability During January, SPKY, experienced some difficulties with cash flow, so it approached one of its vendors about a payment extension. The vendor agreed to the extension on the condition that the company sign a 30-day note that includes 9% interest. What journal entry is needed to record the retirement (and repayment) of the note on the maturity date? a. Debit notes payable and credit cash b. Debit notes payable, debit interest expense, and credit cash. c. Debit notes payable, credit interest expense, and credit cash. d. Debit accounts payable, debit interest expense, and credit notes payable. QUESTION 86 On January 2, Year 1, Kalahari Limited issued 1,000,000 10-year bonds for $1,150,000. The bonds pay interest on June 30 and December 31 . The stated rate is 10% and the market rate is 8%. The company plans to use the effective interest method for amortizing bond discounts and premiums. Refer to Kalahari Limited. What is the carrying value of the bonds at the end of 10 years before the final maturity payment is made? 25500,000 b. $540,000 c$1,000,000 d$1,150,000 A cookie company includes one premium coupon in every cookie package. Upon returning 10 such coupons to the company, the customer will be sent a free cookie jar. In a recent year, the company sold 200,000 packages of cookies for $1 per package. It is estimated that 20% of the coupons will be redeemed. If the cookie jars cost the company $3 each, what amount of liability should be recorded? a. $4,000 b. $12,000 c $40.000 d. $200,000 QUESTION 84 Equipment with an estimated residual value of $15,000 at acquisition was sold on December 31 , Year 1 , for $20,000 cash. The following information was available at the time of sale: acquisition cost, $100,000; accumulated depreciated on December 31 , Year 1 , after adjustment, $85,000. When this transaction is recorded, which of the following should be included? a. a credit of $20,000 to the equipment account b. a credit of $5,000 to the gain on disposal account c. a debit of $80,000 to the loss on disposal account d.a debit of $20,000 to the accumulated depreciation account A retail company issues numerous discount coupons throughout the year. What is indicated by a balance in the estimated liability account? a. an error in posting b. the amount of coupons already redeemed c more coupons were redeemed than estimated d. the amount of coupons expected to be redeemed in the future QUESTION 82 On January 1, Year 1 a company signed a five-year, $90,000 note payable at 11% simple annual interest. The company keeps its records on a calendar-year basis. How much interest expense will be recorded on December 31. Year 4 ? a. 50 b. 31,930 c $9,900 d. $36,900 On January 2, Year 1, SPI-K Limited issued 1,000,000 10-year bonds for $1,150,000. The bonds pay interest on June 30 and December 31 . The stated rate is 10% and the market rate is 8%. The company plans to use the effective interest method for amortizing bond discounts and premiums. What is the semiannual cash payment on the bonds? a. $46,000 0. $50,000 c $57,500 a. $92,000 QUESTION 80 On May 1, a company borrowed $30,000 from the Great Western Bank on a one-year, 6% note, The company keeps its records on a calendar-year basis. What entry is needed on December 31 ist? a. Increase interest expense by $600. b. Decrease interest payable by $600. c Increase interest payable by $1,200. a. Increase interest expense by $1,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts