Question: no hand- writing. show the formula 5 points Save Answer Assume that you are considering the purchase of a 20-year, noncallable bond with an annual

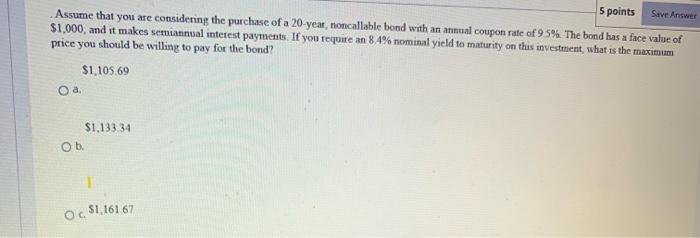

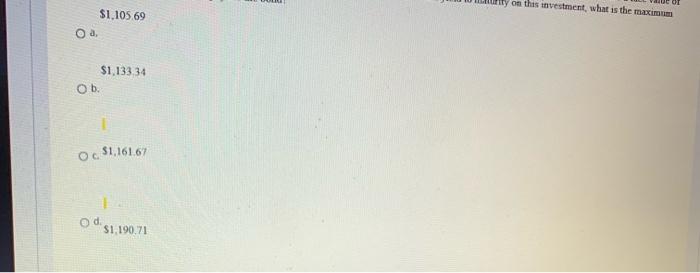

5 points Save Answer Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. The bond has a face value of $1.000, and it makes semiannual interest payments. If you require an 84% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond? $1,105.69 O a. $1.133 34 Ob. . 51.161 67 on this investment, what is the maximum $1.105 69 oa, $1,133 34 Ob. oc $1,16167 Od S1.190.71

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts