Question: no handwriten please Chapter 8 6. Beta and CAPM Currently under consideration is an investment with a beta, B, of 1.50. At this time, the

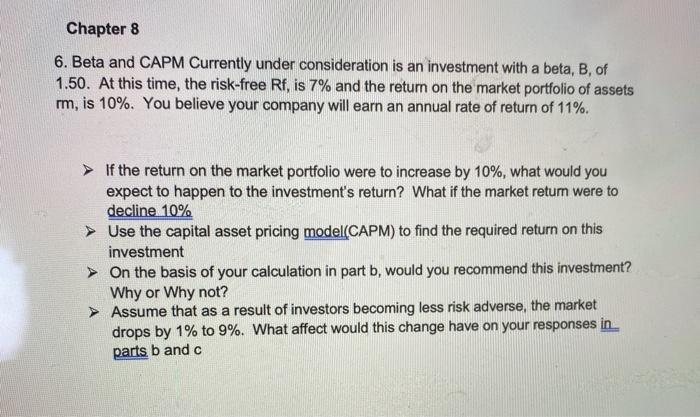

Chapter 8 6. Beta and CAPM Currently under consideration is an investment with a beta, B, of 1.50. At this time, the risk-free Rf, is 7% and the return on the market portfolio of assets rm, is 10%. You believe your company will earn an annual rate of return of 11%. If the return on the market portfolio were to increase by 10%, what would you expect to happen to the investment's return? What if the market retum were to decline 10% Use the capital asset pricing model(CAPM) to find the required return on this investment > On the basis of your calculation in part b, would you recommend this investment? Why or Why not? Assume that as a result of investors becoming less risk adverse, the market drops by 1% to 9%. What affect would this change have on your responses in parts b and c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts