Question: No idea how to do #30 Fairfield Tractor put a markup of 32% on cost on a par for which it paid $73.50. Find (a)

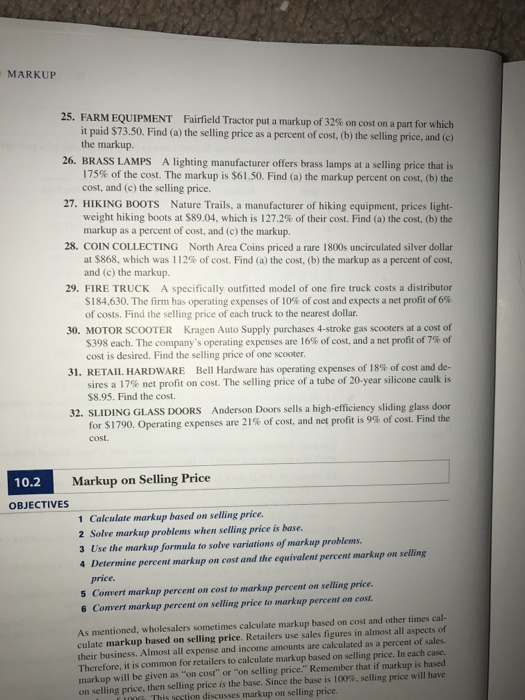

Fairfield Tractor put a markup of 32% on cost on a par for which it paid $73.50. Find (a) the selling price as a percent of cost, (b) the selling price, and (c) the markup. A lighting manufacturer offers brass lamps at a selling price that is 175% of the cost. The markup is $61,50. Find (a) the markup percent on cost, (b) the cost, and (c) the selling price. Nature Trails, a manufacturer of hiking equipment, prices lightweight hiking boots at $89,04, which is 127.2% of their cost. Find (a) the cost, (b) the markup as a percent of cost, and (c) the markup. North Area Coins priced a rare 1800s uncirculated silver dollar at $868, which was 112% of cost. Find (a) the cost, (b) the markup as a percent or cost, and (c)the markup. A specifically outfitted model of one fire truck costs a distributor $184,630. The firm has operating expenses of 10% of cost and expects a net profit of 6% of costs. Find the selling price of each truck to the nearest dollar. Kragen Auto Supply purchases 4-stroke gas scooters at a cost of $398 each. The company's operating expenses are 16% of cost, and a net profit of 7% of cost is desired. Find the telling price of one scooter. Bell Hardware has operating expenses of 18% of cost and desires a 17% net profit on cost. The selling price of a tube of 20-year silicone caulk $8.95. Find the cost. Anderson Doors sells a high-efficiency sliding glass door for $1790. Operating expenses are 21% of cost, and net profit is 9% of cost. Find the cost. Calculate markup based on selling price. Solve markup problems when selling price is base. Use the markup formula to solve variations of markup problems. Determine percent markup on cost and the equivalent percent markup on selling price. Convert markup percent on cost to markup percent on selling price. Convert markup percent on selling price to markup percent on cost. As mentioned, wholesalers sometimes calculate markup based on cost and other times calculate markup based on selling price. Retailers use sales figures in almost all aspects of their business. Almost all expense and income amounts are calculate as a percent of sales. Therefore, it is common for retailers to calculate markup based on selling price. In each case, markup will be given as "on cost" or" on selling price. "Remember that if markup is based on selling price, then selling price is the base. Since the base is 100%, selling price will have. This section discusses markup on selling price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts