Question: No matter how many different variations i try nothing is working for this. Please help. Lobster Trap Company is considering automating its manufacturing facility. Company

No matter how many different variations i try nothing is working for this. Please help.

No matter how many different variations i try nothing is working for this. Please help.

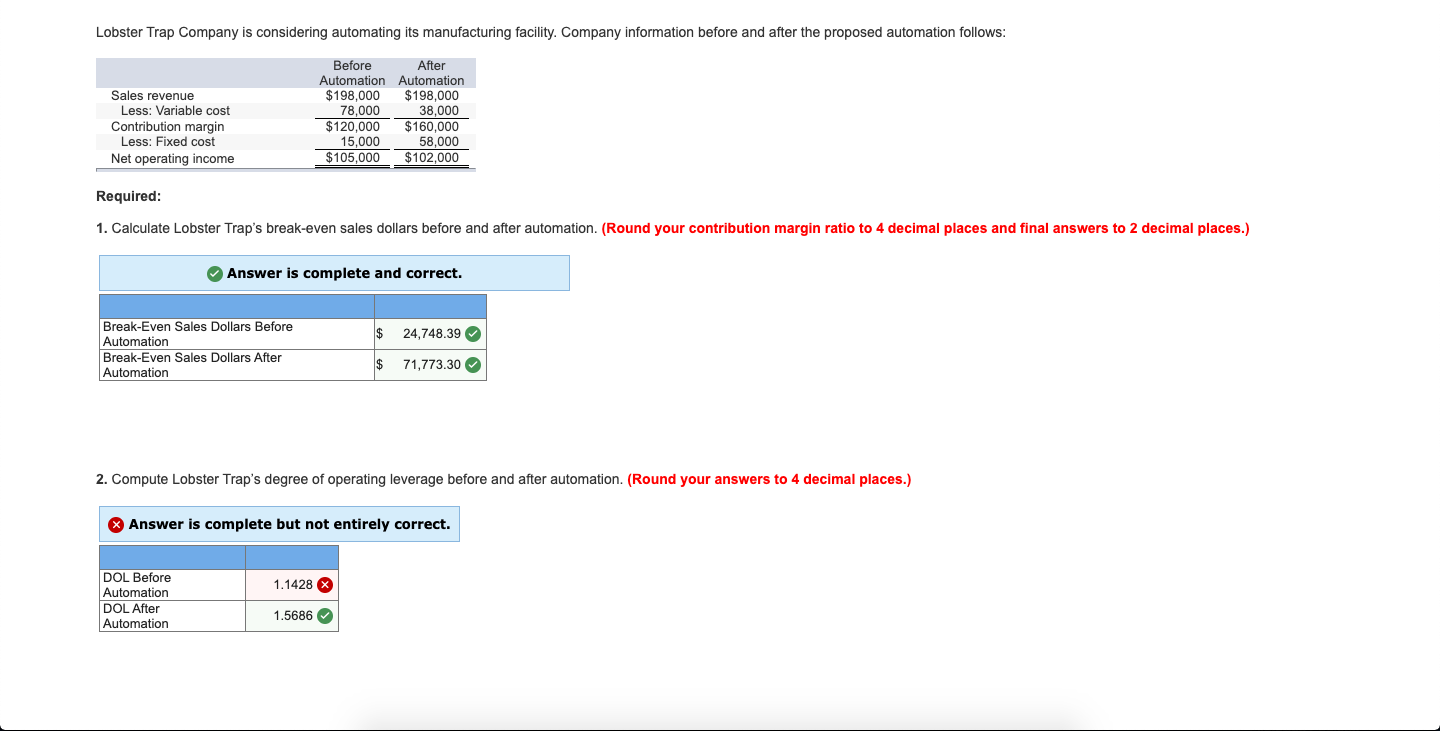

Lobster Trap Company is considering automating its manufacturing facility. Company information before and after the proposed automation follows: Sales revenue Less: Variable cost Contribution margin Less: Fixed cost Net operating income Before After Automation Automation $198,000 $198,000 78,000 38,000 $120,000 $160,000 15,000 58,000 $105,000 $102,000 Required: 1. Calculate Lobster Trap's break-even sales dollars before and after automation. (Round your contribution margin ratio to 4 decimal places and final answers to 2 decimal places.) Answer is complete and correct. $ 24,748.39 Break-Even Sales Dollars Before Automation Break-Even Sales Dollars After Automation $ 71,773.30 2. Compute Lobster Trap's degree of operating leverage before and after automation. (Round your answers to 4 decimal places.) Answer is complete but not entirely correct. 1.1428 X DOL Before Automation DOL After Automation 1.5686

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts